by John Bone

University of Aberdeen

Sociological Research Online, 19 (4), 1

<http://www.socresonline.org.uk/19/4/1.html>

DOI: 10.5153/sro.3491

Received: 5 Nov 2012 | Accepted: 1 Oct 2014 | Published: 30 Nov 2014

This paper offers a critical analysis, including insights from the fledgling sub-discipline of neurosociology, with the aim of challenging some of the key assumptions informing the state supported revival of the UK private rented sector (PRS) as a mainstream form of housing tenure. As is widely recognised, the PRS's expansion has occurred in tandem with the long running decline of social housing and the more recent reversal in the longstanding trend towards increasing owner occupation. This paper asserts that the policies supporting this overall trend are misconceived on a number of fronts, as the loosely regulated UK private rented sector is not only a major contributor to the country's ongoing housing crisis but carries with it a range of unacknowledged economic and social problems including profound effects on personal well-being, some fairly evident and others less so. With respect to the latter, it is argued that coming to an understanding of the negative implications of private renting in the UK under current arrangements, in addition to the more evident issues associated with poor condition and high cost accommodation, also requires an appreciation of the deeper psycho-social effects of involuntary mobility, insecurity and socio-spatial dislocation.

A family on average income is nowhere near able to afford a house at the average price (Vince Cable, Business Secretary, 4 April 2013)

1.1 It is clear that the UK has a serious housing crisis, an issue subject to growing public, media and political debate. This has largely been precipitated by the contraction of the social housing sector over the last 30 years or so and, more recently, by a reversal in the long running expansion of owner occupation, which has been rendered prohibitively expensive for many new entrants since the 'noughties' house price boom. Evidently, the latter was driven by the pre-crisis expansion of mortgage credit offered by a deregulated banking sector, and facilitated by its employment of increasingly 'innovative' financial engineering. The growth and proliferation of mortgage products, in turn, funded a rise in speculative property investment from, mainly, small scale investors seeking to capitalise on rising prices and rents. The consequent problems of rising costs and competition ensuing from the extended financialisation of the UK housing market prompted policymakers across the mainstream political spectrum, in addition to offering various schemes to support mortgage lending, to turn to a resurgent private renting sector (PRS) as the main housing solution for the growing numbers now unable to buy or, alternatively, to access increasingly scarce social housing (Bone and O'Reilly 2010). This paper argues, however, that in addition to the ironies inherent in advocating causal factors of the housing crisis as potential solutions, the promotion of the UK PRS in its current form is also misguided from the standpoint that, for a variety of reasons outlined here, it is wholly unsuitable as a mainstream housing tenure.

1.2 The paper draws on a range of sources and theoretical perspectives, including important insights from the fledgling field of neurosociology, to argue that the problems associated with the return to mass private renting in the UK, and particularly the chronic insecurity of tenure experienced by many private sector tenants, may be generating significantly more profound negative social and personal effects than are currently acknowledged. These issues are explored within the context of an overview of the historical and contemporary problems associated with private renting and, indeed, recent UK housing policy more generally.

Private renting was a housing tenure in terminal decline through most of the twentieth century. In the 1920's, powerful and subsidized competitors, owner occupation and council housing, began to eat into the historic position of private renting as the normal housing tenure of nineteenth-century industrial society (Lowe 2007: 2-3).

2.1 Throughout the 19th century the overwhelming majority of the UK population (cc 90 per cent) had been housed in the private rented sector, providing income to a property owning upper class (Hughes and Lowe 2007).

The landlords are not ashamed to let dwellings ... the floors of which stand at least two feet below the low-water level …, where the ground floor, utterly uninhabitable, stands deprived of all fittings for doors and windows... (Engels 1844: 52).As above, the standard of housing on offer in the poorer areas of the rapidly expanding industrial cities was a source of private discontent and public concern; often highly insecure, overcrowded, squalid and unsafe (Engels 1844; Roberts [1971] 1990). Moreover, despite the privations associated with renting in the poorer districts, housing was expensive in relative terms, taking up a large proportion of weekly incomes.

2.2 The angst generated by poor housing and high rents remained a central social and political issue into the early 20th century and was starkly illustrated in the form of large scale rent strikes in 1914 and 1915, as tenants in Leeds and Glasgow withheld their rents in protest over large increases being imposed, particularly during a period when large numbers of the main wage earners were off fighting in the Great War. Such was the widespread unrest generated by landlords' actions that, in Glasgow, this cause was supported by the threat of mass industrial action in the shipyards and beyond, the prospect of which led to the introduction of legislation restricting rents to pre-war levels (Moorhouse et al 1972; Glynn 2009).

The early development of public health and housing policy re?ected a focus on housing shortage and housing conditions: slums, sharing and overcrowding and threats to the health and well-being associated with ?tness for habitation, housing quality and provision of basic amenities (Murie 2009: 535).

2.3 State intervention in housing became increasingly evident during the first half of the 20th century, albeit that this trend was somewhat uneven prior to the Second World War, with a resurgence of private renting and associated social problems occurring in the 1930s. Post WWII housing policy, however, as is widely acknowledged, ushered in a more comprehensive shift encompassing the regulation of private lettings to direct provision of secure and affordable housing, of much improved quality, via local authorities by mandate of the state or, alternatively, through state support for owner occupation (Francis 1997). Even as the post-war housing market evolved, however, lingering problems with the private rented sector persisted such that the PRS remained a source of public concern (Green 1979). Accordingly, the sector's role was gradually reduced to that of an increasingly regulated and marginal form of tenure, largely catering for students and young singles, new migrants and people in various stages of life course transition. This remedial set of arrangements, as is also well understood, has been subject to substantial retrenchment with the return to 'free markets' of the neoliberal era (Bone and O'Reilly 2010).

3.1 The exhaustively documented 1970s neoliberal challenge to the post-war social democratic model sought redress for what its exponents characterised as a 'sclerotic', 'state dependent' and 'anti-enterprise' regulatory culture within British society. Alongside the 'freeing up' of the financial sector and a vast array of policies promoting privatisation and business deregulation - including the flexibilisation of labour markets - 'socialised' housing was considered ripe for reform (Riddell 1985). Consequently, there was an almost wholesale dismantling of the post-war mixed market in housing, via the 'right-to-buy' and the sale of heavily discounted council housing to existing tenants, and through support for home ownership generally. Moreover, since the mid-1990s the application of various fiscal and legislative devices, in tandem with new financial products, has stimulated the recent revival of the PRS, with the sector expanding rapidly during the housing boom. By contrast, the social housing once envisioned as a mass affordable, secure and socially mixed alternative to private housing, through a process of residualisation, has also been redefined as a marginal, 'subsidised'[1] housing tenure for the poor (Burrows 1999; Glynn 2009; Fitzpatrick and Pawson 2013).

|

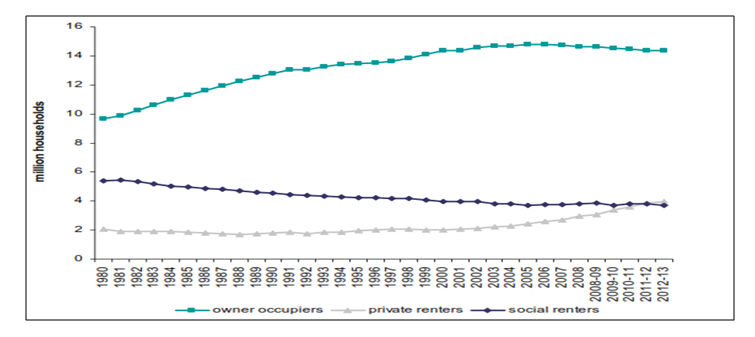

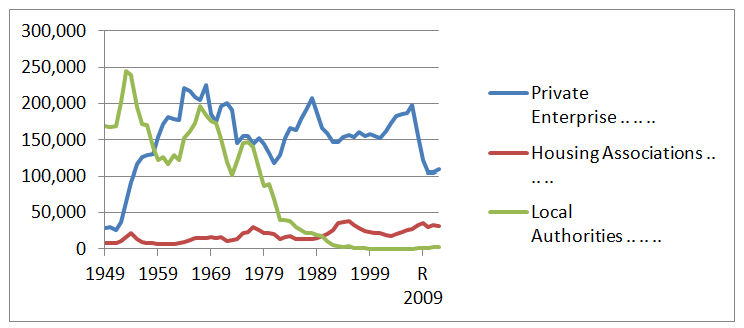

| Figure 1:Housing Tenure in the UK (England) (DCLG 2014) |

3.2 Figure 1 illustrates the trends described above, charting the ongoing contraction of public housing in favour of owner occupation since the early 1980s, the more recent decline of the latter during since the housing boom, and the concomitant rise in private renting. Moreover, amid more restrained post-crisis lending to first time buyers, extensive competition from investor landlords has continued to play a significant role in raising prices and squeezing potential new entrants out of owner occupation. This has left increasing numbers with little option but to rent privately the sort of homes that previously they would have been able to buy (Bone and O'Reilly 2010). As discussed in more detail below, a number of government schemes have emerged ostensibly aimed at assisting new home buyers, in terms of improving access to mortgage funds. However, as many of these initiatives have tended to support prices rather than substantially stimulate supply, their precise benefits as well as their wider economic implications have been subject to contentious debate.

|

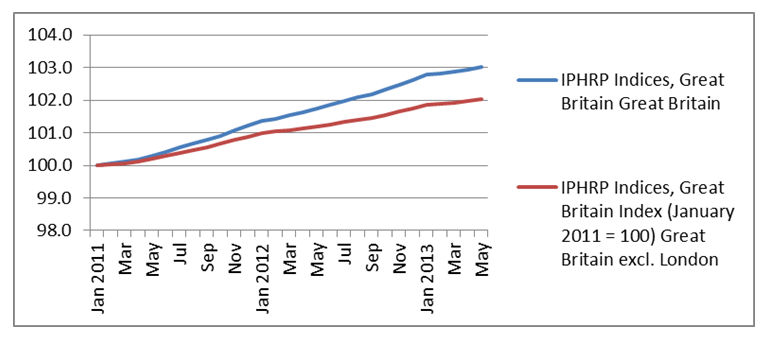

| Figure 2: Index of Private Housing Rental Prices (ONS 2013) |

3.3 While the consequences of historically high house prices have been widely acknowledged the effects of rising costs on the deregulated PRS have also been profound, as the lack of accessible alternatives has seen private sector rents continue to rise. In qualification, it may be noted that there are considerable regional variations in rent levels, reinforcing notions of a UK 'North/South divide', given that London and other areas of particularly high demand in the South have commensurately higher rents as well as house prices[2]. Nonetheless, as Figure 2 above illustrates, an inexorable increase in costs has been the general trend.

3.4 When considering the impact of rising rents it is also important to note that this scenario has evolved against a backdrop of high unemployment, underemployment, casualisation and below inflation wage increases (Lansley 2011; Shildrick et al. 2012). Thus, there is a growing constituency of those who find themselves in the expanding peripheries of both the job and housing markets (Bone 2009b; Standing 2011). The combined effects of reduced job opportunities, stagnating incomes and high housing costs have also contributed to a significant decline in independent living amongst young UK adults, as illustrated in Figure 3 (below).

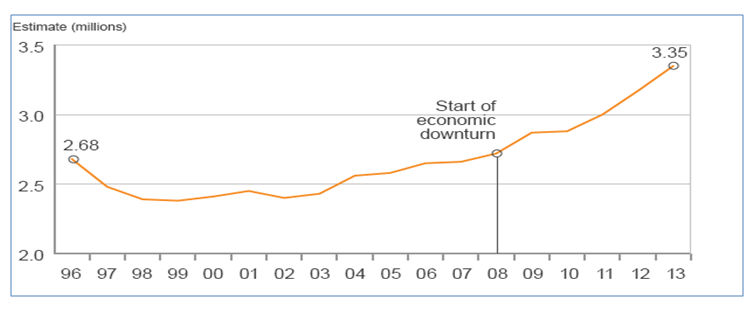

|

| Figure 3: Adults aged 20-34 (1996-2013) living with parents (ONS 2013) |

4.1 As suggested above, the structure and functioning of housing markets is evidently dependent upon the legislative and regulatory arrangements mandated by the state. The current UK framework, it can be argued, is one that has shifted from treating housing as an essential utility towards housing as an investment vehicle, increasingly favouring the interests of the financial and property sectors, including the growing army of private landlords. With respect to the latter, in addition to benefiting from a range of advantageous regulatory changes (discussed below), landlords can offset rental income against mortgage payments for tax purposes, affording them a significant financial advantage over prospective first time buyers (Bone and O'Reilly 2010). Perhaps more politically sensitive, however, is the fact that many private rented sector mortgages are effectively paid, in whole or in part, through the housing benefit system.

4.2 An ongoing 'moral panic' in the UK press over the increasing 'burden' imposed by the welfare system can, to some extent, be attributed to the rising numbers of housing benefit recipients being housed in increasingly expensive private rented accommodation, as the more affordable social housing alternative has contracted. According to DCLG Housing Survey figures (2011-12), claimants in the PRS typically receive around 57% more per week in housing benefit than their counterparts in social housing. With respect to the latter, many housing benefit recipients occupy former local authority housing that has found its way into the hands of private landlords via right-to-buy, the outcome being that the state now pays a substantial premium to house tenants in the same accommodation that formerly could have been rented from a local authority at significantly lower cost. As the ranks of the poorly paid, underemployed and jobless has expanded since the credit crisis, this has exerted a considerable impact upon this call on public funds (Standing 2011; Lansley 2011). Consequently, and consistent with the current welfare reform agenda, a good deal of government and media attention has focused on the need to reduce housing benefit costs.

The bedroom tax is one of these once-in-a-generation decisions that is wrong in every respect. It's bad policy, it's bad economics, it's bad for hundreds of thousands of ordinary people whose lives will be made difficult for no benefit – and I think it's about to become profoundly bad politics (David Orr, Chief Executive, National Housing Federation (NHF), March, 2013).

4.3 It is evident that one cost saving initiative, the 'spare room subsidy' or 'bedroom tax', has proven particularly contentious. It is impractical in this piece to outline all of the implications of this policy. Briefly, the legislation aims to deduct 'a fixed percentage of the Housing Benefit eligible rent… set at 14% for one extra bedroom and 25% for two or more extra bedrooms' from social housing tenants deemed to have 'spare rooms' (NHF 2013). The asserted aim is to move social housing tenants out of 'under-occupied' accommodation into smaller homes, freeing these up for others, while also lowering the benefit bill.

4.4 Amid the highly charged debate surrounding this policy, particular attention has been given to the position of disabled people and other groups who, for one reason or another, need 'extra' living space (NHF 2013). Aside from these precise concerns, however, the wider logic of the policy has been challenged on practical as well as ethical grounds. Firstly, the obvious point has been raised that there is very little prospect of people finding accommodation of the correct size, so defined, within the greatly depleted UK social housing sector. Indeed, current evidence suggests that tenants are being effectively left with the option of finding additional monies from already stretched incomes or moving to smaller accommodation in the PRS. In the first instance more pressure is placed on family finances and, perversely, the second option invariably entails that those relocating to the PRS would be charged a higher rent for potentially lesser and more insecure accommodation (Stephenson 2013). Moreover, little consideration appears to have been given to the considerable one-off costs of relocation, personal as well as economic, being imposed on a vulnerable sector of society.

4.5 With respect to private sector tenants receiving benefits, key changes to Local Housing Allowance (the form of Housing Benefit received by private renters) have also been subject to criticism. Local Housing Allowance (LHA) is ostensibly designed to match benefit levels to both family size (number of rooms) and average rental costs on a regional basis. Thus, a room restriction on funding for accommodation already applied to private sector lets. Welfare reform, however, has seen both a cap on increases to LHA set at 1%per annum, entailing that rent rises tend to continually outstrip benefit uprating, as well as a reduction in the levels of assistance available in relation to local rental markets, where the maximum available has been reduced from 50% to 30% of local median rents. There has also been a shift in the age related entitlement to benefit for 'younger' single claimants where those under 35 (as opposed to 25 previously) are restricted to claiming Shared Accommodation Rate (SAR), covering the cost of a single room in a flat/house share, rather than being eligible to claim LHA for a separate property. In research conducted for the DWP, some landlords noted that they would now be reluctant to let to the under 35s at all given the issues involved in managing houses in multiple occupation (HMOs) (DWP 2013). Overall, these changes have entailed that, as with the implications of the bedroom tax for social housing tenants, there is also an increasing squeeze on PRS benefits recipients' capacity to access and sustain suitable accommodation.

4.6 The prospective roll out of Universal Credit, that bundles all benefits together into one single payment, is likely to impose further difficulties on claimants[3] Aside from the general squeeze on benefits, the proposed move to monthly rather than the current weekly payments raises the evident prospect that many cash strapped recipients will run short of money before the end of a month. Given the understandable prioritisation of food and energy it also seems reasonable to conclude that Universal Credit - assuming it is ever implemented nationally given ongoing problems with its implementation in pilot areas - will exacerbate these negative effects, pushing increasing numbers into rent arrears and eviction.

4.7 Overall, the current direction of government policy suggests that while those on low wages and the unemployed have retained the right to some assistance with accommodation, albeit on increasingly meagre terms, it may be argued that they have lost the right to have a secure and settled 'home'. This scenario not only applies to renters, however, as assistance for unemployed homeowners - (Support for Mortgage Interest (SMI) - has also become progressively less generous.

4.8 While changes to the welfare system are compounding housing insecurity, other planks of housing policy are placing home ownership further out of reach. Notably, 'Help to Buy' stands out as being the most radical and controversial of a sequence of government interventions aimed at supporting mortgage lending and home buying. Under the first phase of this two part scheme the UK government offers 20% interest free loans for five years on new build properties to buyers who can raise a 5% deposit. The second phase of the scheme provides a guarantee to lenders of 15% of the advance on loans for the purchase of pre-owned property, once more providing that the purchaser contributes 5%. In terms of both phases the taxpayer assumes a proportion of the risk on new mortgages advances while effectively supporting the return of 95% loans (DCLG 2013).

The housing market needs help to supply, not help to buy and the extension of this scheme is very dangerous...Government guarantees will not increase the supply of homes, but they will drive up prices at a time when it seems likely that house prices are already over-valued (Graeme Leach, Chief Economist at the Institute of Directors, The Telegraph, 19 August 2013)

4.9 As above, this Conservative led initiative has attracted criticism even from some of its own traditional constituency, and from the government's own Liberal Democrat Business Secretary, Vince Cable. The chief criticism is that it risks further inflating an already overvalued asset class. At the time of writing this appears well underway, driven by this and earlier government schemes, such as Funding for Lending, one effect of which was the lowering of interest rates on mortgages, including buy-to-let products. (Council of Mortgage Lenders (CML) August 2013). With such interventions to 'refuel' mortgage lending the UK government appears to have shifted focus from an asserted aim of rebalancing the economy in favour of manufacturing to reviving the debt fuelled expansion, house price inflation, speculation and consumption that has dominated the UK economy over the last few decades; the precise strategy that produced the serial booms and busts that culminated with the credit crunch (Bone 2010).

The Help to Buy scheme is an utter travesty. The government reckon they have a policy that will help me and other young adults, but it's managing to achieve the exact opposite, condemning thousands of us every month to a lifetime at the mercy of landlords (Dan Wilson Craw, PricedOut, 19 February 2014).

4.10 As above, Help to Buy has also been condemned by the very groups representing its asserted beneficiaries, prospective first time buyers, who see the policy as being aimed at supporting overvalued house prices, favouring existing homeowners, banks, landlords and housebuilders. Their position is that first time buyers would be better served by a return to 'normal' credit conditions, substantially increased supply, and less government support for property investment (http://www.pricedout.org.uk/policy).

4.11 Government assertions that the boosting of mortgage credit would stimulate a substantial rise in new building may be treated with considerable caution given both current experience and that during the credit bubble where, as discussed below, supply did not substantially increase in relation to the level of increased demand (see Figure 5).

4.12 Overall, Help to Buy, as with other forms of government stimulus, merely exacerbates the dilemma that prospective FTBs find themselves in. Thus, they are left with the prospect of renting in perpetuity as house prices rise further out of reach or, for those who can, assuming highly risky levels of debt to purchase significantly overvalued property in an artificially inflated market, where any future increase in historically low interest rates and/or withdrawal of government support may easily lead to long term onerous debt servicing, negative equity or repossession.

In comparison to social renting and owner occupation, the PRS has some of the worst housing conditions in terms of facilities and services, and levels of disrepair and un?tness ... Damp, condensation, overcrowding, and inadequate cooking and heating facilities are widespread in the sector and not only simply cause inconvenience but also have an effect upon the health and well-being of tenants (Lister 2006).

5.1 While the central concern of this piece is housing insecurity, evidently one cannot consider the broader implications of the return to mass private renting without addressing the question of housing quality. In this it seems clear that the PRS, as noted above, both historically and currently, comes off as being much the poorest in terms of quality in comparison to other forms of tenure. This is not to suggest that all contemporary private landlords offer poor quality accommodation (Leyshon and French 2009). However, in the absence of effective regulation, some landlords will inevitably deliver a poor service, particularly where housing is in scarce supply and the tenant has few options. It might also be tentatively argued that, even if one sets aside the differences in the regulatory framework applicable to private renting in the UK and nations such as Germany, the UK sector can be seen to operate within a relatively more aggressively acquisitive culture (Bone 2009).

5.2 As implied above, it would be erroneous to suggest that all landlords are the same, in that some undoubtedly have a concern for their tenants and entered the market with a view to generating long term income, while others became 'accidental' landlords due to circumstances, i.e. those needing to move but unable to sell in a post-crash market. However, it also seems clear that a significant number of BTL landlords entered the market with a view to making speculative capital gains, viewing housing investment as a potential path to swift and easy riches. (Osborne 2006).

The private rented sector offers a flexible form of tenure and meets a wide range of housing needs. It contributes to greater labour market mobility and is increasingly the tenure of choice (my italics) for young people (DCLG 2013).

6.1 Returning to the issue of insecurity, 'flexibility' is often suggested as one of the key reasons for young people opting to rent rather than buy (Ball 2006; 2010). The implication here is that the sector has grown as a consequence of shifting lifestyle preferences rather than limited choice and financial constraints. However, while this may be the case for students and some young single people in transition between education and more permanent household formation, it is difficult to find much support for this view or to understand private renting's appeal beyond this sector. Nonetheless, many policymakers and property commentators who endorse the extension of private renting cite the situation in mainland European nations, and notably Germany, where long term renting is common, as a rationale for expanding the PRS in the UK. Such comparisons, however, ignore the evident fact that the encouragement of investment into the UK sector has been orchestrated through the dismantling of any vestige of the type of regulatory framework that renders private renting in nations such as Germany relatively secure, affordable and thus viable as a longer term housing solution (Kemp and Kofner 2010).

People cite the continental rental model – but don't realise that this is based on a much more equitable property market. Germany has many people in rented accommodation, but they also have much stronger tenancy laws and a much longer-term and less rapacious investment model. (Matt Griffith, 'PricedOut', The Guardian, 4 June 2011).

6.2 As above, the deregulation of the UK PRS entails that it is a relatively insecure prospect from the tenant's standpoint. The 1988 Housing Act (further revised in 1996) greatly reduced tenants' rights and introduced the Assured Shorthold Tenancy (AST), while the 1996 revision coincided with the financial sector's launching of the buy-to-let mortgage (Ball 2006). The AST is now the predominant tenancy agreement offered to new tenants and normally only guarantees six months tenure, while tenants can be evicted thereafter on two months' notice from the landlord (Ball 2010). It was largely due to this revision that it became much more attractive for investors to engage in the property speculation that contributed to the housing boom (Bone and O'Reilly 2010).

6.3 Although some commentators consider the letting terms of UK tenancies to be relatively unproblematic, as is discussed in more detail below this ignores the anxieties and difficulties this might entail for individuals, families and communities attempting to establish stable households and put down roots (Rugg and Rhodes 2008; Keeble 2008; Fitzpatrick and Pawson 2013).

|

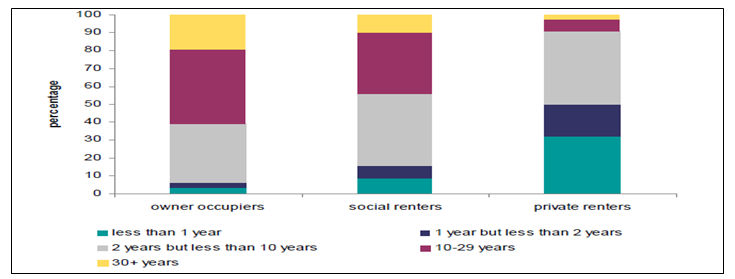

| Figure 4: Length of residence in current home by tenure, 2011-12 English Housing Survey (DCLG 2013) |

6.4 As Figure 4 illustrates the PRS has by far the highest turnover of any housing tenure. What is also crucial to note, however, is that it is not just actual involuntary relocation that can have an impact on private tenants but the ever present awareness that one's home can be removed at very short notice with all of the anxiety and upheaval this entails (Fitzpatrick and Pawson 2013). Research by Shelter has also critically undermined the aforementioned contention that for the majority of people private renting is a preferred lifestyle choice, this is particularly the case for families, the number of whom renting in the PRS has doubled in the last decade (Shelter 2013).

Nearly two thirds of renting families (64%) would like to own their own home but don't think they will ever be able to afford it. 60% of families are living in the sector because they cannot afford to own their own home. Fewer than 10% like the freedom and flexibility it gives them (Shelter 2013: 1).

6.5 It may be argued that the positive discourse with respect to flexible provision in the PRS is informed by a particular set of assumptions regarding individuals and societies; assumptions that are consistent with the currently dominant neoliberal political and economic orthodoxy. Thus, one of the tenets of neoliberalism is an insistence that 'flexibility' and fluidity are positive for individuals, economy and society, while too much security fosters sclerosis and 'dependency' (Harvey 2005; Bone 2010).

6.6 It is this perspective when applied to housing that, for the reasons outlined earlier, can at least in part be seen to have informed the Right to Buy policy of the 1980's and the removal of much of the decent, secure and affordable social rented stock. This vision can also be seen to underlie more recent initiatives to 'reform' social housing, bringing remaining social tenancies more into line with those of the deregulated private sector (Greenhalgh and Moss 2009). The 'freeing' up of the housing market, the neoliberal logic asserts, removes the barriers that inhibit people from being pro-active, starting businesses, regularly moving around for work and so on, thus, they become more 'adaptive' and self-reliant as they meet the needs of a 'dynamic' economy and deregulated labour market. In short, as noted above, the end of the 'home for life' appears as the logical counterpart to the demise of the 'job for life' and the concomitant extension of 'flexible' employment contracts, heralding a radically more precarious existence for growing numbers of UK citizens (Standing 2011).

The Government believes that strong and stable families of all kinds are the bedrock of a strong and stable society

(https://www.conservatives.com/Policy/Where_we_stand/Family.aspx)

...today's volatile rental market is simply not fit for purpose. For the vast majority of renting parents, renting isn't a lifestyle choice, yet for many it's putting their children's education, happiness and wellbeing in jeopardy. Unpredictable rents and short-term tenancies are not only failing to meet the needs of families, they're doing real damage to children's lives (Campbell Robb, Shelter Chief Executive, 2013).

7.1 While the issue of 'dependency' is dealt with more directly below, it nonetheless seems clear that raising children in such conditions is a potentially angst ridden proposition and, thus, appears diametrically opposed to the government's much promulgated emphasis on the stability of families. Questions evidently arise as to how children can be adequately socialised, educated, form longstanding bonds with peers and so on, when they can be uprooted at a few weeks' notice, and where the prospect of homelessness is an ever present possibility if suitable and affordable accommodation is not quickly secured. Further compounding such concerns is the consideration that, in a society where people are constantly on the move, already fragile communities and support networks become ever more dislocated and diluted within 'fluid' neighbourhoods. This not only appears fundamentally inconsistent with the once widely asserted aims of the ill-starred 'Big Society' agenda but, as is addressed in more detail below, also ignores the widely recognised association between social fragmentation, isolation and a broad range of psychological and social ills (Durkheim 1965; Wirth 1938; Congdon 2011).

7.2 Many of the issues discussed above have been integral to longstanding housing debates, albeit that they have acquired fresh significance given the current state of the housing market (Atkinson et al 2011; Fitzpatrick and Pawson 2013). However, as noted at the outset, a central aim of this paper is also to address some of the perhaps less evident implications of insecure housing tenure, asserting that these may be less clearly understood by both supporters and critics of the status quo.

…relevant to explaining geographic variation in suicide and self-harm is social fragmentation, meaning low community integration associated with high population turnover, short stay private renting, (my italics) many one person households, and many adults outside married relationships (Congdon 2011: 26).

8.1 As suggested, the neoliberal conception of the individual and the collective seems largely at odds with current social scientific understandings of human capacities and propensities[4]. In short, advocates of the former tend to lionise an image of individuals who 'thrive' on competition, adversity, insecurity and challenge (albeit that one suspects this to be mostly advanced as a condition best applied to other people), while the latter tends to hold that our tolerance to such circumstances is somewhat limited. Clearly, our view of these dispositions has a crucial bearing on how we might evaluate the potential effects of current conditions in the UK PRS.

8.2 One caveat here might be that some sociological visions of contemporary selfhood, principally the once fashionable postmodern 'playful self', might appear superficially suited to a life of flux and fluidity (Featherstone 1991). Nonetheless, it can be argued that such constructs are largely informed by, and only really applicable to, a wealthy cosmopolitan sector of society, whose lifestyle and experience of 'mobility' and so on is clearly distinctive from that of the less privileged (Elliott and Urry 2010; Bauman 1996).

8.3 In contrast to imaginings of the highly malleable self, it is almost a touchstone of psychology that consistent change and chronic insecurity, where people have little continuity and control in their lives, is at the root of much personal stress, mental ill health and poor emotional and, indeed, physical well-being (Catalano 1991). Sociology has long identified similar themes, where individuals who are separated from the conditions affording the construction of consistent and coherent identities – that are fostered and supported by strong social ties forged in stable, secure and relatively predicable environments - are subject to a range of psychic and social ills with both individual and collective ramifications. Durkheim's concept of 'anomie' and Wirth's notion of 'social disorganisation' offer foundational sociological identifications of the social problems generated by individual insecurity and communal instability (Durkheim 1965; Wirth 1938). Moreover, developments in the neurosciences over the last few decades have now begun to lend further support, insight and empirical grounding to this broad perspective that were evidently not available to earlier theorists.

8.4 Within sociology, recent but growing interest in such findings has led to the emergence of a fledgling sub-discipline, neurosociology, which seeks to explore social processes from both a (neuro)biological as well as socio-cultural standpoint (Franks 2010; Bone 2005; 2006; 2010). With particular relevance for the current argument is the observation that human beings' limited capacity to deal with uncontrolled change, while varying to some extent between individuals, appears nonetheless to be a relatively 'inelastic' condition imposed by particular aspects of the structure and functioning of the brain. Thus, we exhibit constraints in handling conscious processing of information, and thus experience, due to the limited capacity of our working memory (Plass et al 2010). We generally manage this by routinising many of our well-practiced responses, developing schema and procedural practices that can be deployed at a low level of consciousness such that we can readily accommodate to familiar tasks and experiences, freeing up our limited attention for dealing with novel situations or those deemed particularly significant in light of past experience.[5] This effectively limits the 'cognitive load' that we are routinely exposed to (Ledoux 1998; Plass et al 2010).

8.5 By contrast, where the limits of tolerable cognitive load are tested an 'emotional alarm' is experienced due to the fact that we no longer feel in full control of our circumstances and, thus, may not be adequately prepared and ready to focus on and deal with what life throws our way.[6] Moreover, where the perception of 'uncontrol' persists the associated pattern of negative emotional arousal may eventually produce a chronic state of anxiety and/or potentially the 'learned helplessness' we associate with clinical depression (LeDoux 1998; Bone 2010).

8.6 In qualification, it must be noted that too much predictability and routine may also be problematic, in that we require a degree of diversity and concomitant emotional arousal to render everyday life meaningful. The point, however, is that there appears to be an approximately optimal state consistent with achieving a modicum of balance between these two polarities, i.e. when we have a sense of control, stability, predictability and security while encountering a modicum of novelty and/or stimulation sufficient to keep life interesting; on one side of this equilibrium state lies boredom and bewilderment and on the other fear, anger and existential angst (Csikszentmihalyi 1975; Bowlby 1988; Bone 2010).

8.7 The 'real world' implications of this process are perhaps evident, and thus the relevance to the argument at hand, in that maintaining our cognitive and emotional burden at manageable levels is dependent on there being a degree of simplicity, stability and continuity in our circumstances, or at least a level of change and complexity that is sufficiently moderate that we can confront novel experiences without being overwhelmed (Ledoux 1998; Bone 2010).

8.8 This perspective is not only robustly evidenced but is also consistent with classical sociological observations regarding the demands that living in modern urban settings imposes on individuals. As Simmel notably observed in his identification of the 'nervous exhaustion' experienced by the new city dwellers of the industrial revolution, we are constantly vulnerable to such experiences (1903). It may well be the case that living in a complex modern urban society, of itself, consistently taxes the cognitive and emotional coping capacities of a species that evolved in far 'simpler' environments, while this notion is further supported by very recent evidence suggesting a relationship between urban living and increased neurological sensitivity to stress (Lederbogen et al 2011). If this is given credence, it may be further argued that neoliberalism may exacerbate these conditions by undermining the fragile but crucial pillars of stability afforded by the 'job for life' and secure housing that emerged in the mid-20th century (Bone 2009). Moreover, neurosociology may also point towards a subtler and even deeper reason as to why the 'flexible' free market approach to housing in particular may contribute to social malaise, fractured relationships, identities and psychological distress.

Emotional connection to place is an intensely personal and visceral phenomenon (Jones and Evans 2012: 2321).

8.9 The relationship between geographical space and identity formation has been widely addressed across a number of disciplines, including those specifically focusing on housing issues. While it is impossible in this piece to engage with these debates in depth, a broad range of studies within the housing field have also underscored the negative economic, social and psychological effects of involuntary displacement for various groups across a variety of settings, for example, where associated with processes of urban redevelopment, gentrification, landlord repossession and unmanageable rental increases (Zukin 1982; Atkinson 2000; Newman & Wyly 2006; Atkinson et al 2011). What emerges, from a variety of these sources is robust evidence of the often disorientating impact of relocation, most particularly where this is imposed rather than chosen (Atkinson et al 2011; Fitzpatrick and Pawson 2013).

8.10 With respect to more theoretically oriented discussion, a good deal of this is concerned with the symbolic meaning of space for particular groups i.e. the manner in which mythological and romantic images of the homeland mobilise local and national identities and sentiments (Anderson 1983). There has also been recognition of the more personal and emotional attachment to particular places (Relph 1976; Tuan 1977). As Relph states, '(T)o be attached to places and have profound ties with them is an important human need' (Relph 1976: 38).

8.11 It can be argued, however, that lesser attention has been devoted to understanding the deeper and more complex interrelationships between physical location, emotion, memory and identity that might contribute to the observed effects of involuntary displacement.

8.12 Inexorably associated with the processes described above, a key factor in the individual's ability to control and manage experience, sustaining feelings of security, is the capacity to sustain a coherent and consistent identity. Stated plainly, to feel secure we need to have confidence in both the consistency and coherence of our world and how and where we as individuals fit (Giddens 1991). In turn, stable identity is evidently dependent upon the extent to which we can sustain a relatively consistent narrative/biography of our life to date, supported by our ongoing relationships and interaction with others (Atchley 1989). Current understandings of the manner in which we acquire long term memories suggest that there may also be a spatial dimension to this overall process. This hypothesis is founded on the notion that one of the principle structures in the brain associated with the formation of the long term semantic and episodic memories that constitute our internalised perceptions of selfhood and the lifeworld, the hippocampus, has also been identified as a structure centrally implicated in orienting us in geographical space (O'Keefe and Nadel 1978). Thus, in constructing our knowledge of the world and our relationship to it human beings may be effectively building upon an evolutionary capacity to represent the topography and individually relevant features of the physical environment in memory - including memories of opportunities, threats and associated positive and negative experiences - where human development has simply allowed us to retain and employ a much richer and more symbolically abstracted, temporally extended and detailed 'map' than other animals (Bone 2010).

8.13 Augmenting sociological conceptions of the social construction of the self - as being dependent on interactions with others within social networks - our interaction with the spatial environment may also be regarded as an important ingredient in the process of self formation (Elias 1939). Thus, selfhood might be even more fully understood as arising within a matrix of meaningful attachments and relationships with both other people and the physical environment, with each contributing to the construction of lifeworld and identity (Elias 1939; Tuan 1977). In short, while tentative, there may be some grounds for considering that the relationship between the physical environment and identity formation and stability may be more significant than hitherto imagined, and consequently the negative effects of involuntary relocation, such as that experienced by many PRS tenants, may be correspondingly more profound.

In the displacement literature some researchers have found that people who are forced to move operate in a kind of mourning for the areas and lives they have left behind…More commonly it was easy to see the kind of dejection and resentment generated among those who had been displaced (Atkinson et al 2011: 44-45).

8.14 It may be that those who have little choice in the matter experience geographical movement as involving an unnerving wrench and reorientation that is difficult to accommodate to, most particularly where this is a recurrent experience. On this point, one caveat here is that those who do this through choice or with strong collective support may manage and control the experience, pace and circumstances of such transitions sufficiently that there are few perceptible ill effects. Nonetheless, the trend towards imposing a form of atomised nomadism on the 'housing poor' may have a range of unacknowledged implications. In short, stable selves may be founded upon both stable relationships and stable locations, and may not be readily forged and sustained in highly fragmented, insecure and constantly shifting locales.

|

| Figure 5: Housebuilding in the UK 1949-2012 (DCLG 2014) |

9.1 At present, the very idea that we could, or should, return to a more stable, controlled or mixed economy in housing appears anathema to policymakers wedded to the neoliberal model[7]. In the first instance, private solutions are always assumed to be superior to public solutions, thus the focus remains on increasingly expensive owner occupation and expanded private renting in spite of the fact that this model is patently not delivering. Moreover, as suggested, housing demand has not been met by anything approaching adequate new supply (see Fig. 5).

9.2 Given all of the above, a revival of public/social house building would seem to be a very obvious solution. From a very evident perspective, offering an accessible, affordable, secure and attractive alternative would reduce the capacity of housebuilders and landlords to capitalise on scarcity, while also limiting the scope for lenders to inflate prices through irresponsible credit expansion. Widely accessible and good quality public housing would likely mean that mortgage repayments would need to retain some reasonable relationship to public sector rents, thus the current scenario of homebuyers assuming mortgage debt to the very limits of affordability would be less likely. Overall, in a mixed market both house prices and private rents would need to be more realistic and quality consistently improved, while private landlords would also have to provide greater tenant security to remain in business. Speculative investment in housing would also be rendered less of a one way bet, potentially channelling savings into more productive investment, while reducing the sector's capacity to generate wider economic instability. .

9.3 A mass housebuilding programme would also stimulate the economy in a more positive direction, creating jobs in the construction sector and beyond, while ensuing lower housing costs overall would evidently also reduce the housing benefit bill. Household disposable income, no longer so heavily committed to servicing high mortgages and rents would also boost economic activity, as would the increased demand for the various household goods that would arise with increased housing supply[8]. In short, such a policy, as in the past, could contribute to a more 'virtuous' economic cycle and, crucially, an economy less reliant on ever increasing household debt.

9.4 As to the arguments levelled against this type of approach, the current much promulgated view that public housing is sub-standard can also be directly challenged in that, while far from perfect, it has a much better record than the PRS in this regard. Many contemporary critics of social housing pointedly ignore the fact that much of the 'successful' public housing - and particularly that built prior to the fixation with the 'high-rise' Corbusier inspired 'brutalism' of the late 1960s and 70s - was of such good quality that most was sold off to eager tenants (Greenhalgh and Moss 2009). In fact, it might be argued that it was precisely the mass sell-off of desirable, good quality properties that has allowed critics of social housing to depict the tenure as run down 'barracks for the poor' (Ibid. 2009).

9.5 As noted above, however, a significant neoliberal objection to reappraising the role of public housing in a mixed market, the 'dependency' argument, I would suggest requires particular scrutiny

An additional risk factor to health and wellbeing is the lack of security in the private rented sector and the proposed reduction of security in the local authority sector. An Australian study has found that an increase in housing security is correlated with improved achievement and behaviour by children (Phibbs and Young 2005 as cited by the Pro-Housing Alliance 2011)

9.6 It is clear that antipathy towards secure housing in the public sector, or regulated housing in the private sector for that matter, rests on the notion that security breeds indolence and a lack of ambition (Greenhalgh and Moss 2009). In the first instance, it might simply be noted that this does not appear to be the experience in those nations with more regulated housing markets (or indeed regulated labour markets and more generous welfare systems), as social mobility and economic growth are regularly higher than current levels in the UK. Moreover, it is also well understood that both economic growth and social mobility were higher in the UK in the 1950s and 60s, prior to the neoliberal transformation of the economy, than has been the case in recent decades (Harvey 2005). This reflects the experience of other developed nations, as those who have most eagerly embraced the neoliberal turn tend to be the most unequal, economically turbulent and socially sclerotic (Quiggin 2010).

9.7 There are now also very sound reasons for assuming that individuals in insecure circumstances tend to focus on very narrow, immediate and short term contingencies (Fredrickson and Brannigan 2005). This is evidently not a good foundation for the sort of creativity, advanced planning, measured and rational action or even considered and moderate risk taking that is associated with personal and collective development, economic or otherwise.

9.8 It may be suggested that good societies and well-functioning economies require stable foundations, while secure housing is evidently fundamental to this process. Moreover, if housing, and indeed, income security were the impediments to individual motivation, and thus wider economic and social development, that neoliberals appear to suggest, it might logically be asked why the better off and their offspring should be not be as urgently divested of this 'burden' as the poor, via increased property, land and inheritance taxes.

The human right to adequate housing, which is thus derived from the right to an adequate standard of living, is of central importance for the enjoyment of all economic, social and cultural rights (OHCHR 1991).

9.9 As above, the United Nations considers housing provision as being central to the delivery of human rights, where affordability, security of tenure and continuous improvement in living conditions are highlighted as essential elements of decent housing arrangements (Office of the High Commissioner for Human Rights (OHCHR 1991). By contrast, both the inadequacy of current arrangements as well as the contentious nature of the housing debate was underlined during a visit to the UK by the UN Special Rapporteur on Housing, Raquel Rolnik in late summer 2013. The envoy's widely publicised comments, particularly with reference to the aforementioned under-occupancy charge, that 'it should be suspended' and that the policy represented a 'danger of a retrogression in the right to adequate housing', was denounced as being 'biased and one sided' by Conservative Party Chairman, and former Housing Minister, Grant Shapps (BBC, 11 September 2013). The UN envoy's diagnosis, however, can be seen as emblematic of how far UK housing arrangements are now falling short in terms of meeting the needs of, in particular, its less fortunate citizenry.

10.1 As argued above, secure and affordable housing of a decent standard, in tandem with decent jobs, act as crucial pillars of stability within the potentially bewildering milieu of modern societies. These social goods render the task of contemporary living infinitely more manageable, a fact that becomes ever more apparent with advances in our understanding of human psychosocial proclivities and needs. For the wealthy these securities are readily accessible, such that they are often held in surplus, while for the poor in highly unequal societies like the UK they often have to be vigorously defended. From a sociological perspective, this seems an unremarkable contention which resonates with many of our foundational concepts (Durkheim 1965). Secure housing of a fit standard must be viewed as an essential feature of a progressive and civilised society, as a basic right and necessary condition for individual and collective well-being. It was a broad acceptance of this view that drove the transformation of the post-war housing market which, while in many ways imperfect and incomplete, nonetheless transformed lives. In dismantling this consensus the neoliberal approach to housing, as with labour markets, has once more set a growing sector of the public adrift in an anomic and anxious scramble for any vestige of security they can find, while reviving some of the inequities of a darker past. In sum, while the logic of this overall strategy can be criticised on purely economic grounds, the current direction of housing policy is also wholly incompatible with the conditions that support decent lives, stable families and a good society, while the broader ramifications over the longer term may be multi-faceted, deeply damaging and not always immediately apparent.

1It might be noted that the suggestion that public housing is subsidised is highly debatable, given that rents in the sector cover the costs of building and maintenance over a reasonable time frame, and are thus not subsidised in the conventional sense. The 'subsidy' identified by critics of social housing refers to the notional gap between public sector and private sector rents. In effect, the alleged subsidy is a consequence of social housing costs being associated with a much reduced element of private profit, rather than any implied direct taxpayer subsidy.

2A further caveat here is that some 'pockets' in the north, for example Edinburgh and Aberdeen, have very high house prices and rental costs.

3This assumes, of course, that Universal Credit will be implemented nationally, which is not guaranteed at the time of writing given various problems with its introduction.

4This not only applies to the notion that individuals thrive on 'flexibility' and insecurity, but also to notions applicable to the economic sphere i.e. the rational economic actor that informs neo-classical economics.

5Working memory (thought to be associated with the pre-frontal cortex [pfc]) is central to conscious processing and has a very limited capacity. This is why well practiced tasks etc. must be 'hived off' such that they can be handled almost instinctively, much as we once focused a good deal of attention while learning to drive but can now handle the physical movements required with little conscious attention.

6A primary function of the brain is to keep us safe, while the fear system is evidently designed to identify and facilitate memory formation with respect to threats in our environment. When we experience cognitive overload, however, we are in a state where we cannot be certain that we can identify and deal with potential threat and, thus, feel out of control and anxious as the fear system reflects this state by raising the 'emotional alarm'.

7On a minor caveat here, it appears that the UK Labour opposition has of late begun to take on board some of the issues outlined above, in terms of the problems of housing conditions, cost and indeed security in the PRS. (http://www.labour.org.uk/uploads/adaa0b53-702a-4a84-e110-7261b2d5abea.pdf) Evidently, this represents a significant shift from their position in office where they presided over, and seemed relatively sanguine regarding, both the housing boom and the rapid expansion of a deregulated buy-to-let sector. However, it remains to be seen how far the party has travelled in terms of housing policy should they return to office in the near future.

8The point here is that the profits from rising house prices and high private rents tend to come from the pockets of those on moderate to lower incomes, who spend rather than save, and fall into the hands of the wealthy who are likely to retain much more of their income.

ANDERSON, B (1983) Imagined Communities, London: Verso.

ATCHLEY, R C (1989). 'A Continuity Theory of Normal Ageing'. The Gerontologist, Vol. 29, No. 2, p. 183-190.

ATKINSON, R (2000) 'Measuring gentrification and displacement in Greater London', Urban Studies, Vol. 37, p. 149–165.

ATKINSON, R et al. (2011) Gentrification and Displacement: the household impacts of neighbourhood change, AHURI Final Report 160, Melbourne: Australian Housing and Urban Research Institute.

BALL, M (2006) The Revolution: 10 years on, assessment and prospect, Association of Residential Letting Agents (ARLA)

BALL, M (2010) The UK private rented sector as a source of affordable accommodation, Report for the Joseph Rowntree Foundation

BAUMANN, Z (1996) 'From Pilgrim to Tourist - or a Short History of Identity', in Stuart Hall and Paul du Gay (Eds.), Questions of Cultural Identity, London: Sage.

BONE, J (2005) The Social Map & the Problem of Order: A Re-evaluation of 'Homo Sociologicus', Theory & Science, Vol.6 Issue 1 http://theoryandscience.icaap.org/content/vol6.1/bone.html.

BONE, J (2006) The Social Map: Cohesion, Conflict and National Identity, Nationalism & Ethnic Politics, Vol. 12 Issues 3-4, p. 347-72.

BONE, J (2009) The Credit Crunch: Neoliberalism, Financialisation and the Gekkoisation of Society, Sociological Research Online, Vol. 14 Issues 2/3 http://www.socresonline.org.uk/14/2/11.html.

BONE, J (2010) Irrational Capitalism: The Social Map, Neoliberalism and the Demodernization of the West, Critical Sociology, Vol. 36 Issue 5, p. 717-740.

BONE J & O'Reilly K (2010) No Place Called Home: The Causes and Social Consequences of the UK Housing 'Bubble' British Journal of Sociology, Vol. 61 Issue 2, p. 231-255.

BOWLBY, J (1988) A Secure Base: Clinical Applications of Attachment Theory, London: Routledge.

BURROWS, R. (1999) Residential Mobility and Residualisation in Social Housing in England, Journal of Social Policy, 28, p.27-52.

CATALANO, R (1991) The Health Effects of Economic Insecurity, Am. J. Public Health, Vol 81, p. 1148-52.

CONGDON, P (2011) Explaining the Spatial Pattern of Suicide and Self-Harm Rates: A Case Study of East and South East England, Applied Spatial Analysis, Vol. 4, p. 23-43.

CSIKSZENTMIHALYI, M (1975) Beyond Boredom and Anxiety: experiencing flow in work and play, San Francisco: Jossey-Bass.

DURKHEIM, E (1965) The Elementary Forms of the Religious Life, New York: Free Press.

ELIAS, N (1939) The Civilising Process 1, Oxford: Blackwell.

ELLIOTT, A and Urry, J (2010) Mobile Lives, London: Routledge.

ENGELS, F (1844) The Condition of the Working Class in England, Oxford: Oxford University Press.

FEATHERSTONE, M (1991) Consumer Culture and Postmodernism, London: Sage.

FITZPATRICK, S and Pawson, H (2013) Ending Security of Tenure for Social Renters: Transitioning to 'Ambulance Service' Social Housing?, Housing Studies, June, p. 1-19.

FRANCIS, M (1997) Ideas and Policies under Labour 1945–51, Manchester: Manchester University Press.

FRANKS, D (2010) Neurosociology: The Nexus between Neuroscience and Social Psychology, New York: Springer

FREDRICKSON, B L and Branigan, C A (2005) Positive emotions broaden the scope of attention and thought-action repertoires, Cognition and Emotion, Vol. 19, p.313–332.

GIDDENS, A (1991) Modernity and Self-Identity. Self and Society in the Late Modern Age, Cambridge: Polity.

GLYNN, S (Ed) (2009) Where the Other Half Lives: lower income housing in a neoliberal world, London: Pluto Press.

GREEN, S (1979) Rachman, London: Michael Joseph.

GREENHALGH, S and Moss, J (2009) Principles for Social Housing Reform, Localis: http://www.localis.org.uk

HARVEY, D (2005) A Brief History of Neoliberalism, Oxford: Oxford University Press.

HUGHES, D and Lowe, S (2007) The Private rented Housing Market: Regulation or Deregulation? Aldershot: Ashgate.

JONES, P and Evans, J (2012) Rescue Geography: Place Making, Affect and Regeneration, Urban Studies, Vol. 49, July.

KEMP, P and Kofner, S (2010) Contrasting Varieties of Private Renting: England and Germany, International Journal of Housing Policy, Vol. 10, Issue 4, p. 379–398.

LANSLEY, S (2011), Britain's Livelihood Crisis. Touchstone No. 10 (TUC) http://www.tuc.org.uk/sites/default/files/tuc-19639-f0.pdf

LEDERBOGEN, F et al (2011) City living and urban upbringing impact neural social stress processing in humans, Nature 474, p. 498–501.

LEDOUX, J (1998) The Emotional Brain, New York: Simon and Schuster.

LEYSHON, A and French, S (2009) 'We all live in a Robbie Fowler house': The geographies of the buy-to-let market in the UK', British Journal of Politics & International Relations, Vol. 11, Issue 3, p. 438–460.

LISTER, D (2006) 'Unlawful or just awful?: Young people's experiences of living in the private rented sector in England' Young: Nordic Journal of Youth Research, Vol. 14, Issue 2, p. 141–155.

LOWE, S (2007) 'The New Private Rented Sector – Regulation in a Deregulated Market', in Stuart Lowe and David Hughes (Eds.), The Private rented Housing Market: Regulation or Deregulation?, Aldershot: Ashgate.

MOOREHOUSE, B, Wilson, M, Chamberlain, C (1972) 'Rent Strikes—Direct Action and the Working Class' The Socialist Register, Merlin Press.

MURIE, A (2009) The Modernisation of Housing in England, Tijdschrift voor Economische en Sociale Geografie 100, p. 535–548.

NEWMAN, K and Wyly, E (2006) 'The right to stay put, revisited: Gentrification and resistance to displacement in New York City', Urban Studies, Vol. 43, Issue 1, p. 23–57.

O'KEEFE, J and Nadel, L (1978) The Hippocampus as a Cognitive Map, Oxford: Oxford University Press.

OSBORNE, H (2006) 'First-time buyers squeezed out of housing market', The Guardian, 21 September http://www.theguardian.com/business/2006/sep/21/housingmarket.firsttimebuyers

PLASS, JL, Moreno, R and Brunken, R, (Eds.) (2010) Cognitive Load Theory, New York: Cambridge University Press.

QUIGGIN, J (2010) Zombie Economics: How Dead Ideas Still Walk Among Us, Princeton: Princeton University Press.

RELPH, E (1976). Place and placelessness. London: Pion.

RIDDELL, P (1985) The Thatcher Government (2nd Edition), Oxford: Basil Blackwell.

ROBERTS, R ([1971]; 1990) The Classic Slum: Salford Life in the First Quarter of the Century, Harmondsworth: Penguin.

RUGG, J and Rhodes, D (2008) The Private Rented Sector: Its Contribution and Potential, Report for Communities and Local Government, Centre for Housing Policy: University of York.

SIMMEL, G (1903) The Metropolis and Mental Life

SHILDRICK, T, MacDonald, R, Webster, C, and Garthwaite, K (2012) Poverty and Insecurity: Life in low-pay, no-pay Britain, Bristol: Policy Press.

STANDING, G (2011) The Precariat: The New Dangerous Class, London: Bloomsbury.

STEPHENSON, E (2013) Should I Stay or Should I Go?: 100 days of the Bedroom Tax, Bedfordshire: Aragon Housing Association.

TUAN, Y (1977) Space and Place: The Perspective of Experience, Minneapolis: University of Minnesota Press.

WIRTH, L (1938) Urbanism As A Way of Life. American Journal of Sociology, Vol. 44, p. 1-24.

ZUKIN, S (1982) Loft Living: Culture and Capital in Urban Change, Baltimore: Johns Hopkins University Press.