Gender Variations in the Nature of Undeclared Work: Evidence from Ukraine

by Colin C. Williams and John Round

University of Sheffield, University of Birmingham

Sociological Research Online 13(4)7

<http://www.socresonline.org.uk/13/4/7.html>

doi:10.5153/sro.1783

Received: 8 Oct 2007 Accepted: 22 Jul 2008 Published: 31 Jul 2008

Abstract

In recent years, a small but growing tributary of thought has begun to re-theorise the gendered nature of undeclared work by transcending the conventional 'thin' depiction of undeclared work as profit-motivated market-like exchange and constructing 'thicker' representations that recognise the presence of multifarious work relations and motives in this sphere. Given the paucity of empirical accounts that have sought to develop a nuanced theorisation of the gender variations in undeclared work based on such thicker readings, the aim of this paper is to report a study of the gendering of undeclared work in the post-socialist society of Ukraine. Analysing data collected from 600 face-to-face interviews conducted during late 2005 and early 2006 that unravel the work relations and motives involved when men and women engage in undeclared work in Ukraine, the finding is that whilst over two-thirds (68 per cent) of men's undeclared work in this post-socialist society is composed of various types of profit-motivated market-like work, nearly three-quarters (72 per cent) of women's undeclared work is undertaken for friends, neighbours and kin under work relations more akin to unpaid mutual aid and for rationales other than purely financial gain. The consequent argument is that representing undeclared work in conventional 'thin' terms as profit-motivated market-like endeavour depicts such work more through the lens of men's lived practices rather than women's experiences. The paper therefore concludes by calling not only for a re-theorisation of undeclared work and its gendered nature in a wider range of societies and regions of the world but also for a critical evaluation of the validity of depicting monetary transactions as always market-like and profit-motivated.

Keywords: Informal Sector; Underground Economy; Shadow Economy; Gender Divisions of Labour; Envelope Wages; Monetary Exchange; Market Society; New Economic Sociology; Post-Socialism; Ukraine

Introduction

1.1 In recent years, a small tributary of thought has begun to re-theorise the nature of undeclared work. Drawing upon a broader stream of enquiry in which a range of critical, post-colonial, post-structuralist, post-development and post-capitalist commentators have challenged the conventional 'thin' depiction of monetary transactions as universally market-like and profit-motivated, and sought to promulgate 'thicker' representations of the complex and messy characters and logics involved in monetary exchange (Bourdieu 2001; Carrier 1997; Crang 1997; Crewe 2000; Davis 1992; Gibson-Graham 1996, 2006; Kovel 2002; Lee 1996; Slater and Tonkiss 2001; Zelizer 1994, 2005), a number of commentators have begun to re-read undeclared work. Their argument has been that although some undeclared work is market-like and profit-motivated, there is also undeclared work conducted for and by kin, neighbours, friends and acquaintances and for reasons other than financial gain (Cornuel and Duriez 1985; Evans et al. 2006; Jensen and Slack 2008; Nelson and Smith 2008; Persson and Malmer 2006; Pfau-Effinger 2004; Round and Williams 2008; Smith and Stenning 2006; Williams 2004a, 2004b, 2005). Until now, however, few have sought to unravel the gender variations in the character of undeclared work in these 'thicker' terms. Indeed, the only exceptions are a small-scale study in small-town America (Nelson and Smith 2008) and a survey of English localities (Williams and Windebank 2003, 2006).1.2 Given this paucity of empirical accounts grounded in thicker readings of the work relations and motives involved, the aim of this paper is to report a study of the gender variations in the nature of undeclared work in the post-socialist society of Ukraine. In the first section, therefore, a review is provided of how undeclared work is starting to be re-theorised, especially with regard to arguments about the need for thicker representations of the gendering of undeclared work. The second section then reports the methodology underpinning a survey of undeclared work undertaken in Ukraine during late 2005 and early 2006 and the third section analyses the findings of the 600 face-to-face interviews conducted. This will reveal the importance of re-theorising the nature of undeclared work conducted by men and women in terms of the multifarious work relations and motives involved. The final section then concludes by calling for not only a re-theorisation of undeclared work and its gendered characteristics in other societies and regions of the world but also for a wider critical evaluation of the validity of depicting monetary transactions as always market-like and profit-motivated.

1.3 At the outset, however, undeclared work needs to be defined. Adhering to the widespread consensus in the literature, undeclared work refers to remunerated activities that are licit in every sense other than that they are unregistered by, or hidden from, the public authorities for tax, benefit and/or labour law purposes (European Commission 1998; Grabiner 2000; OECD 2002; Thomas 1992; Williams and Windebank 1998). Undeclared work is therefore defined in terms of what is absent from, or insufficient about, it relative to declared work, and the defining absence or insufficiency is that the remuneration is not declared to the state for tax, social security and labour law purposes. If other absences or insufficiencies are also present, then such work is not usually defined as undeclared work. For example, if the goods and services that are not declared are also illegal, then it is not defined as undeclared work but as 'criminal activity'. If there is no remuneration involved in the exchange, meanwhile, then although it is undeclared it is not defined as undeclared work but instead as 'unpaid work'.

Re-theorising Gender Variations in the Nature of Undeclared Work

2.1 Since the 1970s, a large body of thought, much of which has been grounded in feminist enquiry, has questioned the meaning of work (e.g. Beneria 1999; Delphy 1984; Gregory and Windebank 2000; McDowell 1991). Recognising that work is more than employment, and that much of women's work has been hidden from view, a vast literature has emerged that examines various aspects of work beyond employment. The study of undeclared work is firmly situated within this wider project. However, whilst those focusing on unpaid work and its relationship to formal employment have tended to place great emphasis on examining gender divisions of labour, this has not been the case until now when studying paid informal work, or what we here call undeclared work. Indeed, understanding the gender divisions in the undeclared economy remains very much in its infancy.2.2 In major part, this is because for many decades, most of the literature on undeclared work largely focused on measuring its variable magnitude in different populations. The intention in doing so was primarily to display its size and importance. This focus upon its variable magnitude is also apparent in much of the small body of literature that has analysed the gender variations in undeclared work. The emphasis has been upon whether women or men do more undeclared work. The common finding has been that women participate less than men, as displayed in the Netherlands (Van Eck and Kazemeier 1985; Renooy 1990), the UK (MacDonald 1994; Pahl 1984), Italy (Mingione 1991; Vinay 1987), Denmark (Mogensen 1985), the United States (McInnis-Dittrich 1995) and Canada (Lemieux et al. 1994; Fortin et al. 1996). These studies, however, identify only a relatively small gap in men's and women's participation rates. For example, Fortin et al. (1996) find in their study of three Canadian regions that men represent only just over half of all undeclared workers (51.3-52.6 per cent) and merely one per cent more men than women participate in undeclared work. Similar sized gaps in participation rates are also identified in Denmark (Mogensen 1985), the Netherlands (Van Eck and Kazemeier 1985) and Italy (Mingione 1991). However, even if the common finding is that men rather than women constitute the majority of the undeclared labour force, this is not always the case. In Spain and Portugal, for example, Lobo (1990a, 1990b) finds that women rather than men are more likely to conduct undeclared work. Similarly, Williams (2004b) reveals in England that although women were 52 per cent of the sampled population, they conducted 55 per cent of all the undeclared work. It thus appears that the gender configuration of the undeclared labour force varies in different places.

2.3 So far, however, rather fewer have moved beyond evaluating its variable size and analysed whether the nature of men's and women's undeclared work differs. Those studies that have evaluated this issue seem to often come to the same conclusions. On the whole, that is, three key findings have emerged: that the undeclared work of women is lower-paid compared with men (e.g. Fortin et al. 1996; Hellberger and Schwarze 1986; International Labour Office 2002; Lemieux et al 1994; McInnis-Dittrich 1995); that women's undeclared work is more regular but part-time whilst men's is more infrequent but full-time (e.g. Leonard 1994, 1998; McInnis-Dittrich 1995), and that the undeclared work of women and men is confined to similar sectors and occupations to those which women and men find themselves assigned in the formal labour market (Lobo 1990a, 1990b; McInnis-Dittrich 1995). Women, that is, engage in service activities such as commercial cleaning, domestic help, child-care and cooking when they conduct undeclared work. Men, on the other hand, have been found to largely conduct what are conventionally seen as 'masculine tasks' such as building and repair work (Fortin et al. 1996; Jensen et al 1995; Leonard 1994; Mingione 1991; Pahl 1984). So, not only is the gender segmentation of the undeclared labour market characterised by the same sector divisions as formal employment, but also the part-time/full-time dichotomy and wage rates prevalent in formal employment appear to be replicated in the undeclared sphere.

2.4 Differences have also been identified in the motives underpinning undeclared work. For many years, the assumption has been that while men use the money earned from undeclared work as spare cash to finance social activities and to differentiate themselves from the domestic realm, women use the money more to provide for the everyday needs of the household (e.g. Howe 1990; Jordan et al. 1992; Leonard 1994; MacDonald 1994; Morris 1987, 1995; Rowlingson et al. 1997). For both men and women, therefore, undeclared work has been read as embedded in not only market-orientated economic relations but also profit-motivated rationales (e.g. Van Eck and Kazemeier 1985; Fortin et al. 1996; Lemieux et al. 1994; MacDonald 1994; McInnis-Dittrich 1995; Mingione 1991; Mogensen 1990; Pahl 1984; Renooy 1990; Vinay 1987). Since the turn of the millennium, however, this has started to change.

2.5 A major impetus for this re-theorising has been the broader literature on monetary exchange that has evaluated critically whether monetary transactions are always market-like and motivated by personal financial gain. This 'thin' reading of exchange prevails across the full range of economistic discourses ranging from the neo-liberal varieties that celebrate such a view through to Marxian perspectives that depict the hegemony of profit-motivated market exchange as a rallying call for radical change (e.g. Ciscel and Heath 2001; Harvey 1989). It also prevails in the formalist tradition in economic anthropology that reads monetary exchange in contemporary societies to be less embedded, thinner, less loaded with social meaning and less symbolic than in pre-industrial societies (see Mauss 1966). Recently, however, the view that monetary exchange always involves that ubiquitous self-interested rational economic actor, homo oeconomicus, has come under greater critical scrutiny by a range of critical, post-colonial, post-structuralist, post-development and post-capitalist commentators (Bourdieu 2001; Carrier 1997; Davis 1992; Gibson-Graham 1996;Lee 2000; Slater and Tonkiss 2001; Zelizer 1994). Arguing that 'such market-based models … do not convey the richness and messiness of the exchange experience' (Crewe and Gregson 1998: 41), 'thicker' portrayals of monetary transactions have been expounded in which exchange is viewed as 'embedded in ongoing and multiplex networks of interpersonal relationships, rather than being carried out by narrowly rational, atomized actors' (Peck 2003: 7).

2.6 Reflecting this call for a re-theorisation of monetary exchange more broadly, a small stream of literature in the field of undeclared work has similarly begun to question whether this supposed exemplar of the market is always profit-motivated and conducted under anonymous business-like work relations. This issue was first muted during the 1980s in a study by Cornuel and Duriez (1985) who found in French new towns that most undeclared work was composed of exchanges between neighbours and undertaken in order to cement fledgling networks of material and social support. Few at the time, however, paid much attention to the potential theoretical implications of this finding. Since the turn of the millennium, nevertheless, this has begun to alter as the number of studies has increased which find that besides profit-motivated business-like undeclared work, there is also undeclared work conducted for and by kin, neighbours, friends and acquaintances, as well as for not-for-profit motives (Jensen and Slack 2008; Nelson and Smith 2008; Persson and Malmer 2006; Round and Williams 2008; Smith and Stenning 2006; Williams 2004a, 2004b, 2005; Williams and Round 2008).

2.7 In rural Pennsylvania, Jensen and Slack (2008) find that some 61 per cent of all undeclared work in this rural area was conducted chiefly to help out neighbours. Similarly, Nelson and Smith (2008), again in small town North America, find much the same, namely that the profit-motive by no means always underpins engagement in undeclared work. In Sweden, meanwhile, Persson and Malmer (2006: 64) find that over half of undeclared work performed for households was conducted by kin and neighbours. If one adds work colleagues and acquaintances, the figure rises to over 80 per cent. Williams (2004b) similarly identifies in English localities that 7 per cent of undeclared work was conducted by household members, 30 per cent by kin living outside the household, 33 per cent by friends or neighbours and just 30 per cent by people previously unknown to the customer. Contrary to the assumption that consumers and suppliers are 'rational economic actors' engaging in such work to save or make money, Williams (2004b) finds that the primary reason for sourcing undeclared work was saving money in just 31 per cent of cases. Instead, consumers chiefly engaged either to maintain or cement social networks or to help others out. It is similarly the case when suppliers' motives are analysed. Just 50 per cent conducted such work chiefly in order to make money. Some 22 per cent was conducted primarily to help the customer and 28 per cent to cement or build social capital. This was further reinforced by a survey of participants in undeclared work in north Nottinghamshire which again revealed that the vast bulk of undeclared work is conducted by and for kin, friends and neighbours primarily for purposes other than financial gain (Williams 2004a).

2.8 Until now, however, few accounts have sought to evaluate whether the multifarious work relations and motives involved in undeclared work display gender variations. One exception is the qualitative study by Nelson and Smith (Nelson and Smith 1999) in small-town America which teases out how women are more likely than men to conduct such work for closer social relations and for motives other than financial gain. Similarly, a study of 12 English localities finds that the majority of women's undeclared work is conducted for friends, neighbours and kin for reasons other than financial gain, whilst much of men's undeclared work is conducted under profit-motivated market-like exchange relations (Williams and Windebank 2003, 2006). This, however, was based on only a small sample of respondents who were concentrated in a particular locality-type, namely deprived urban neighbourhoods. Until now, therefore, the wider validity of such a finding is not known. No other empirical accounts exist based on this 'thicker' portrayal of the gendered nature of undeclared work. Here, in consequence, the intention is to evaluate the gendered nature of undeclared work in an East-Central European nation, namely Ukraine.

Methodology for Examining Undeclared Work in Ukraine

3.1 Ukraine, the second largest economy among the successor states of the former Soviet Union, has had to confront some severe problems in making its transition to a market society. Not only did official employment decline by about one-third between 1990 and 1999 (Cherneyshev 2006), but some 73 per cent of Ukrainians assert that they receive insufficient income from their main income to buy what they need (Rose 2005) with 80 per cent receiving an income lower than the minimum subsistence level (Moisala 2004) and in global league tables, Ukraine is near the bottom in terms of its levels of corruption and transparency in public life, tax morality and barriers to formalisation (Anderson and Gray 2006; Hanson 2006; Knott and Miller 2006; Transparency International 2005). It might be assumed from this that undeclared work will be rife in this country. Until now, however, few empirical studies have been conducted of undeclared work in Ukraine.3.2 Indeed, the only known source of data on undeclared work in Ukraine is the regular Labour Force Survey which has been conducted by the State Statistics Committee of Ukraine since 2000. This, however, adopts an enterprise-based definition of undeclared work viewing it as employment in undeclared enterprises. This excludes all undeclared work in legitimate enterprises as well as the vast amount of undeclared work conducted on an own account basis. The finding, nevertheless, is that some 16 per cent of employment in Ukraine is in undeclared enterprises (World Bank 2005). The only other estimates of its size in Ukraine come from the indirect measurement methods. These find that undeclared work is 47-53 per cent of GDP using electricity consumption as a proxy indicator (Schneider and Enste 1999), 55-70 per cent using currency-demand estimates (Dzvinka 2002) and 32 per cent using income/expenditure discrepancies (Cherneyshev 2006; Mel'ota and Gregory 2001). Such results, however, have to be treated with caution. Over the past decade, a strong consensus has emerged that such indirect measurement methods are very limited in their usefulness and that carefully designed direct surveys are more accurate when evaluating the extent and character of undeclared work (Brookings Institute 2007; OECD 2002; ONS 2005; Renooy et al. 2004; Williams 2004a, 2006).

3.3 In late 2005 and early 2006, therefore, the first known empirical survey of undeclared work in Ukraine was conducted using the broader and more conventional definition of undeclared work discussed at the outset. Given that previous studies elsewhere reveal significant disparities in the level and nature of undeclared work between affluent and deprived as well as urban and rural populations (Kesteloot and Meert 1999; Leonard 1994; Renooy 1990; Williams 2004b), a decision was taken to use maximum variation sampling to select four contrasting localities. Firstly, and in the capital city of Kiev, an affluent area was chosen, namely Pechersk, heavily populated by government officials and the new business class, along with a deprived neighbourhood, namely Vynogardar, comprised of dilapidated Soviet-era housing with high unemployment and widespread poverty. Continuing the process of maximum variation sampling, the deprived rural area of Vasilikiv was then chosen, which heavily relied on a nearby refrigerator manufacturing plant for its employment until it closed nearly ten years ago and since then has suffered high unemployment, and finally, a town on the Ukrainian/Slovakia border was selected, Užhgorod, which is the fairly affluent capital of the Carpathian region.

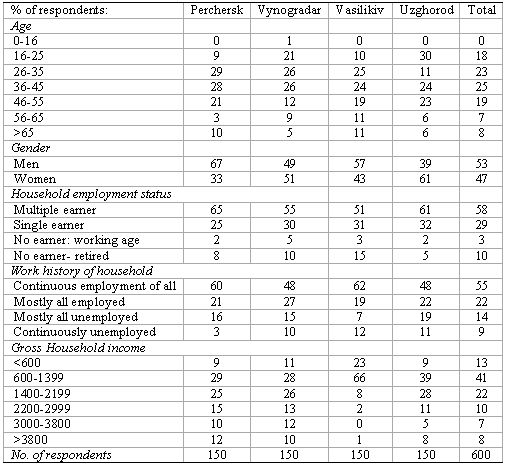

3.4 In each locality, 150 households were interviewed (600 in total). In each household, the 'closest birthday' rule was used to select the person to interview. To select the households, meanwhile, a spatially stratified sampling methodology was employed (Kitchen and Tate 2001). Consequently, if there were 3,000 households in the area and 150 interviews were sought, then the interviewer called at every 20th household. If there was no response and/or the interviewer was refused an interview, then the 21st household was visited, then the 19th, 22nd, 18th and so on. This provided a spatially stratified sample of each area. Table 1 provides a socio-economic profile of the respondents interviewed in each locality. Although this sample is not nationally representative, it nevertheless provides one of the first insights into the nature of undeclared work in Ukraine and its gendered characteristics.

|

| Table 1. Socio-Economic Profile of Ukrainian Households Surveyed, 2005/06: Percentage of Households. |

3.5 To collect data on undeclared work in general and the gendered nature of undeclared work more particularly, structured face-to-face interviews were used. A pilot study using a relatively unstructured interview schedule and mostly open-ended questions revealed that respondents had difficulties recalling instances of undeclared work and comparing the resultant data was problematic. As a result, the decision was taken to use a relatively more structured interview schedule. Besides gathering socio-economic background data on gross household income, the employment status of household members, their employment histories, ages and gender, this firstly asked respondents about what they depend on for their livelihood, secondly, the sources of labour that their household last used to complete 25 common domestic services, thirdly, whether they had undertaken any of these 25 tasks for others (either on a paid or unpaid basis) during the past year, fourthly, a range of open-ended questions about the undeclared work they undertook and its relative importance to their household income and fifth and finally, and using five-point likert scaling, attitudinal questions concerning their views of the economy, politics, everyday life and their future prospects. This paper focuses on the responses related to the extent and nature of undeclared work in general, and the gendered nature of undeclared work in particular, in Ukraine.

The Prevalence of Undeclared Work in Ukraine

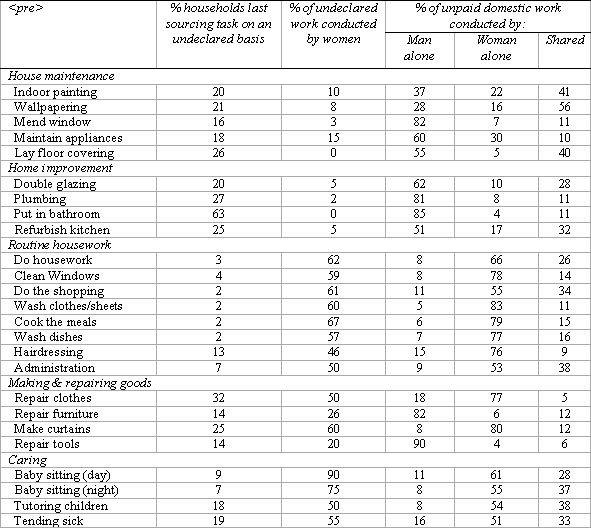

4.1 The first important finding of this survey is that undeclared work is a prominent livelihood practice. Asking respondents about the means they use to secure their livelihood, one in six (16 per cent) assert that the undeclared economy is their main source of livelihood and a further quarter (23 per cent) that undeclared work is the second most important practice they use. In total, therefore, some 40 per cent cite undeclared work as either the principal or secondary contributor to their livelihood. Undeclared work, in consequence, is not a minority practice. Indeed, nearly two-thirds of the population (62 per cent) had engaged in some type of undeclared work in the previous year. Women, however, were more likely to conduct undeclared work than men. Some 64 per cent of all women engaged in undeclared work over the previous year compared with 59 per cent of men, reinforcing in an East-Central European context earlier studies conducted elsewhere which find that women participate less than men (e.g. Fortin et al. 1996; McInnis-Dittrich 1995; Renooy 1990).4.2 To evaluate whether the nature of the undeclared work conducted by men and women differs, Table 2 documents not only whether undeclared work is used to complete a range of common domestic service tasks and if so, whether men or women provide the undeclared labour, but also the gender divisions in undeclared work and unpaid domestic labour across 25 common household tasks. The finding is that the gender divisions in undeclared labour reflect and reinforce the gender divisions of domestic labour. Men largely conduct what are conventionally seen as 'masculine tasks' such as building and repair work whilst women engage in service and caring roles. Interestingly, however, undeclared work is not as heavily gendered as unpaid domestic labour. Paying for household services increases the participation of men, with the exception of caring activities.

|

| Table 2. Comparison of the Gender Divisions of Undeclared Work and Unpaid Domestic Work in Ukraine: by Task (N=600). Source: Author's Ukraine Survey 2005/06. |

4.3 Comparing the gender divisions of domestic labour with the gender divisions of undeclared labour in English localities, however, a different finding emerged. The realm of undeclared work was more heavily gendered than unpaid domestic work in England (Williams and Windebank 2003) but not Ukraine. Why this difference exists between England and Ukraine is open to speculation. Perhaps it is due to the lack of access to formal employment in Ukraine meaning that men have moved into spheres of paid activity conventionally associated with 'women's work' in order to make a living. This is certainly borne out by the qualitative evidence gathered concerning their reasons for engaging in such undeclared labour. Many men doing such these tasks asserted that they did so due to the lack of opportunities for work elsewhere and/or their need to earn an income to secure their livelihood. For example, common statements made by men doing routine housework tasks on an undeclared basis were: 'nothing else was available'; 'there is no regular work so you have to' and 'this was the only way I could earn an income'. As one unemployed man from Pechersk explained,

'I look after my sister's children picking them up from school and looking after them until she gets home from work. She pays me 'under-the-table'. It provides me with a good regular income and helps her out. I have tried to get other proper paid work but there is nothing available.'

4.4 There are also differences in the nature of the employment contracts held by men and women and the wage rates they receive. In Ukraine, women receive lower undeclared wage rates than men (67 per cent of men's rate) and tend to undertake undeclared jobs on a regular and part-time basis (e.g. flower selling, cigarette selling, market work, housework, child- or elder-care) whilst men do such jobs more irregularly but on a full-time basis, such as working on a temporary basis as security guards or on building sites. In the past, this finding has been interpreted to mean that women work as regular but part-time undeclared employees for businesses on low wages and that men work more on an irregular full-time basis as employees for businesses. As will now be revealed, however, this is far too simplistic.

Gender Variations in the Nature of Undeclared Work in Ukraine

5.1 Although in recent decades a wealth of literature has distinguished between undeclared wage employment and undeclared self-employment (International Labour Office 2002; Neef 2002; Williams and Windebank 1998), until now, the multifarious work relations and motives underpinning undeclared work have not been unpacked. Instead, it has been simply assumed that undeclared work is market-like and conducted for financial gain. A small but growing stream of writing, however, has started to do so, resulting in a richer and more textured understanding. Indeed, a continuum of kinds of undeclared work has been recognised, ranging from at one end undeclared employees engaged in forms of work very close to formal employment in terms of the work relations and motives involved, through forms of undeclared work conducted on an own account basis for the purpose of financial gain, to at the other end, undeclared work conducted under work relations more akin to unpaid mutual aid and for purposes other than financial gain (Williams 2004a).

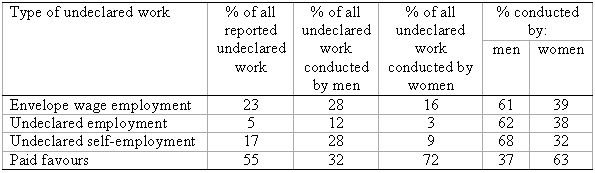

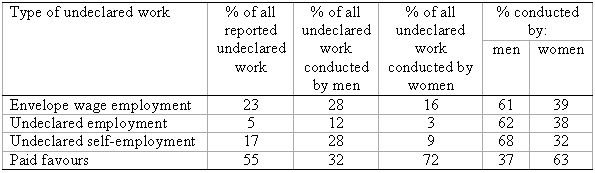

5.2 To unpack the varieties along this spectrum and start to unravel the gendered nature of undeclared work, four broad categories of undeclared work along this continuum are here distinguished that in practice often blur into each other, namely envelope wage employment, undeclared employment, undeclared self-employment and paid favours conducted for kin, friends and neighbours. Table 3 reports the findings concerning the participation of men and women in these different types of undeclared work in Ukraine.

|

| Table 3. Participation of Men and Women in Different Types of Undeclared Work, Ukraine 2005/06. Source: Author's Ukraine Survey 2005/06. |

5.3 Much of the literature on undeclared work has so far focused upon undeclared employment and more particularly on the undeclared waged work conducted by marginalised populations under degrading, low-paid and exploitative 'sweatshop-like' conditions (e.g. Castree et al. 2004; A. Ross 2004), especially in the garment manufacturing sector (e.g. Hapke 2004; R. Ross 2004). Although such undeclared employees cannot be ignored and instances were identified of people being employed under sweatshop-like conditions (of whom 85 per cent were women and 90 per cent did not have a formal job), only a very small portion of all undeclared waged work is of this variety in Ukraine. Indeed, just 5 per cent of all undeclared work reported by respondents involved people working as undeclared employees. To focus on this type of undeclared work therefore is to concentrate on a very small segment of all undeclared work.

5.4 Indeed, the most prominent type of undeclared employee in Ukraine is one who has received very little attention beyond the post-socialist transition economies of East-Central Europe. They are formal employees who receive from their formal employer two wages, an official wage and an additional undeclared 'envelope wage'. Of all reported instances of people receiving undeclared earnings, 23 per cent involved envelope wage payments. The remaining 72 per cent involved various types of own account undeclared work. These exist on a continuum ranging from own account undeclared work conducted for purely profit-motivated purposes (here named 'undeclared self-employment') to own account work undertaken primarily for reasons other than financial gain (here termed 'paid favours').

5.5 There are, however, key differences in the type of undeclared work conducted by men and women. As Table 3 displays, while forms of undeclared work closer to profit-motivated market-like work are conducted in some two-thirds of cases by men rather than women, undeclared work conducted under work relations and for motives more akin to unpaid mutual aid are in nearly two-thirds of cases conducted by women. This signals the principal difference in the nature of women's and men's undeclared work. Indeed, just under three-quarters (72 per cent) of all undeclared work conducted by women is composed of paid favours whilst for men, less than a third (32 per cent) is undertaken on such a basis. This, however, is not the only way in which the nature of undeclared work is heavily gendered. Here, each of these four broad types of undeclared work is analysed in turn so as to unravel other aspects of the gendering of undeclared work in contemporary Ukraine.

Gender Variations in 'Envelope Wage' Employment

5.6 In some East-Central European nations such as Latvia (Sedlenieks 2003; Žabko and Rajevska 2007), Lithuania (Karpuskiene 2007; Woolfson 2007), Romania (Neef 2002) and Russia (Williams and Round 2007), paying a declared employee a portion of their wage on an undeclared basis is a widespread practice. Indeed, this survey reveals that nearly a third of all declared employees (30 per cent) interviewed received an envelope wage and that this amounted on average to 40 per cent of their total wage. Not all formal employees, however, are as likely to be paid an envelope wage. Over a third (35 per cent) of men in declared jobs received an envelope wage compared with a quarter (25 per cent) of women. There was no difference between women and men in terms of the proportion of their total wage paid as an envelope wage.

5.7 The existence of 'envelope wages' has significant implications for pension entitlements and social protection. Those receiving such wages are greatly disadvantaged when they seek to claim unemployment benefits and pension entitlements since a large portion of their wage is not recognised. Indeed, some two-thirds of those receiving envelope wages were opposed to receiving such 'tax-free' wages precisely for this reason. As a woman in her mid-60s living in Kiev stated,

'The trouble is that when you come to claim benefits, they give you hardly anything. They just work it out based on your official wage. You end up getting amounts that make it impossible to even feed and cloth yourself.'

5.8 Envelope wage payments also lead to significant problems when seeking access to credit and loans such as a mortgage. As one man in his mid-30s working in the construction industry stated,

'With my low "official" wage, none of the banks wanted to lend me the amount I wanted for my mortgage. I told them about my envelope wages, they said that they understood but said that they weren't allowed to take it into account. Instead, they said that I would have to find guarantors. The same problem arose. All my work colleagues had pieces of paper with them saying that they earn only US$400 per month which was not enough for the bank. However, all seven had SUV vehicles parked outside – we took the bank manager outside to show them to him and said "this is what we really earn" – in the end he agreed to give me the loan.'

5.9 On the whole, however, banks do not generally take envelope wages into consideration when deciding whether to grant a loan and its size. Indeed, they are perhaps quite correct not to do so. Nearly a third (31 per cent) of all respondents receiving envelope wages asserted that they had witnessed difficulties over the past 12 months in receiving this component of their wage packet. As a woman in her early-20s stated who had worked as a courier during her summer vacation,

'I worked for them and when I asked for my envelope wage which they had promised, they said that the company was in financial difficulties and that I would have to wait another month. I waited until the next month and they then simply said that I was no longer needed. What rubbish…I saw an advert for my job in the paper as soon as I left. They must do it over and over again to people.'Again, no differences were identified between women and men with regard to the difficulties associated with receiving envelope wages.

5.10 Conceptually, meanwhile, envelope wages are important because conventionally in the formal/informal economy dualism, declared and undeclared work are treated as discrete and separate spheres. The prevalence of envelope wages in the declared economy, however, blurs the very distinction between declared and undeclared work since one-third of all declared employment involves undeclared earnings and displays how undeclared work has become part and parcel of contemporary capitalism with employers reducing costs by adopting undeclared payment arrangements.

Gender Variations in Undeclared Employment

5.11 Besides those declared employees receiving a portion of their wage on an undeclared basis, there are also undeclared employees working in businesses where they do not hold a declared job. This takes many forms as Clarke (2002) has previously identified in Russia. On the one hand, there are those working for wholly undeclared enterprises and on the other hand, and more prevalent, those working for declared enterprises that pay a portion of their workforce on an undeclared basis. In Ukraine, some 20 per cent of undeclared employment is in wholly undeclared enterprises (displaying how small is the segment of undeclared work covered by the enterprise-based definition of the State Statistics Committee of Ukraine in its Labour Force Survey). The remaining 80 per cent of undeclared employment is in legitimate organisations where they do not hold a declared job. Although nearly two-thirds (62 per cent) of all undeclared employment is conducted by men in Ukraine, women are more likely to work for declared enterprises on an undeclared basis rather than for wholly undeclared enterprises; some 90 per cent of women engaged in undeclared employment work in declared enterprises and 10 per cent for wholly undeclared enterprises. Meanwhile, just 73 per cent of men engaged in undeclared employment work in declared enterprises and 27 per cent in wholly undeclared enterprises.

5.12 This gender segmentation of the organisations in which men and women conduct their undeclared waged work is reflected in the type of work that they undertake. Of all undeclared waged work identified in Ukraine, some 30 per cent is full-time work and is mostly conducted by men in wholly undeclared enterprises on a temporary or occasional basis, whilst the remaining 70 per cent is part-time and more conducted by women on a regular basis. This undeclared waged work, however, is largely conducted by those with formal jobs. Some 70 per cent of undeclared employment is undertaken by formal employees who do such work to earn additional money.

5.13 Of the 30 per cent of undeclared waged employees who have no formal job, some 66 per cent are women. Often they are either young women or of retirement age. Examples of the work they undertake are multifarious but include serving on market stalls, restaurant work and staffing assembly lines in manufacturing. They tend to be the lowest-paid of all undeclared workers. An example is an 88 year old woman who we interviewed who earns her income by selling flowers from her dacha on the street just outside a market and does so in order to earn enough money to buy essential food items.

Gender Variations in Undeclared Self-Employment

5.14 Of all reported instances of undeclared work, some 17 per cent involved working on an own-account or self-employed basis primarily for the purpose of financial gain. Some two-thirds (68 per cent) of this undeclared self-employment is undertaken by men.

5.15 There are also differences in the nature of the undeclared self-employment carried out by men and women. In recent decades, it has been widely argued, especially in the majority ('third') world (International Labour Office 2002), that undeclared self-employment represents an important seedbed for enterprise creation and development. This is reinforced in this Ukraine study. Of the 298 individuals interviewed who had started-up a self-employed enterprise in the last three years, nine out of ten had done so without registering their enterprise and seeking a licence, and two-thirds (65 per cent) at the time of the survey were still operating on an unregistered basis and working wholly undeclared. Of these wholly undeclared enterprises, some two-thirds were operated by women. Of those who had registered their enterprise, meanwhile, 85 per cent reported that they were conducting a portion of their trade on an undeclared basis and three-quarters were operated by men. In Ukraine, therefore, there is a large 'hidden enterprise culture' and the undeclared realm acts as an incubator for the vast majority of enterprise and entrepreneurship, as some have previously intimated might be the case (Roberts and Fagan 1999; Roberts et al. 2000).

5.16 It is not correct, however, that all undeclared self-employed are 'necessity' entrepreneurs engaged in such work as a survival strategy in the absence of alternatives. Although a portion of the undeclared self-employed conduct such work out of necessity, such as the women interviewed who work as street-side flower-sellers and cigarette sellers at railway stations, by no means all undeclared self-employed are necessity-driven. This is clearly depicted in Table 4 which reveals that the undeclared self-employed are clustered at the two ends of the income spectrum in both the lowest- and highest-income quartiles.

|

| Table 4. Distribution of the Undeclared Self-Employed: by Gross Household Income. Source: 2005/6 Ukraine survey. |

5.17 On the one hand, there are the undeclared self-employed in the lowest-income quartile. Largely women, some 85 per cent do not have a declared job and rely on this undeclared endeavour for their livelihood. Engaged in poorly remunerated work, the vast majority assert that they would prefer a 'normal' formal job so as to minimise their risks of being cheated, robbed and to be able to have paid leave, but did not have the opportunity to do so. Instead, they relied on largely piecemeal undeclared own-account work. Explaining their reasons for engaging in such work, they commonly stated that they did so 'out of necessity', 'to make ends meet', 'to survive', 'to scrape together enough to feed and cloth themselves' and so forth. As such, these are largely necessity-driven own account workers eking out a living in this sphere as a last resort and in the absence of alternatives.

5.18 On the other hand are the undeclared self-employed in the highest-income quartile composed largely of men. This includes not only university teachers who provide 'coaching' for the university entrance examinations and school teachers who provide after-school additional lessons for pupils, but also software engineers providing informal services for the clients of the business in which they are formally employed, and self-employed plumbers, electricians and builders conducting a portion or all of their business informally. Such off-the-books self-employment is relatively well-paid and in nearly half (45 per cent) of all cases, the opportunities for this undeclared work directly arise out of their declared employment or self-employment. Most saw nothing wrong with working on an undeclared basis. As one man in his mid-40s living in Kiev and operating a tax business stated,

'We are not the crooks for not paying our taxes. The crooks are those who demand bribes to renew our licence, bribes to pick up from the railway station, bribes to use the airport, bribes to pick up from certain hotels. And even if you do pay your taxes, it just goes into the pockets of the state officials. None of it goes to paying for welfare, road improvements or anything.'

5.19 For many of these undeclared self-employed, therefore, it was the state and its officials who were corrupt and they viewed themselves as entrepreneurs and part of the burgeoning 'capitalist' culture in Ukraine but who were forced to operate on an undeclared basis due to the corruption, bribery and bureaucracy inherent in the 'old' system that they were helping replace.

Gender Variations in Paid Favours

5.20 This survey reveals for the first time the existence of undeclared work conducted for closer social relations and for rationales other than making or saving money in post-socialist societies. It also reveals that some 55 per cent of all undeclared work is of this variety (rising to 65 per cent in the rural area of Vasilikiv). These paid favours, moreover, are conducted in nearly two-thirds (63 per cent) of cases by women, and some 72 per cent of women's undeclared work is composed of paid favours compared with just 32 per cent of men's undeclared work.

5.21 Some 18 per cent of all undeclared work was provided for not-for-profit rationales to kin living outside the household, 23 per cent for friends and 14 per cent for neighbours. Indeed, paying for favours is popular in Ukraine. Examining all instances where people provided favours to kin, friends and neighbours, this survey reveals that some 41 per cent involved payment. Indeed, some 36 per cent of kin exchanges involved payment, 56 per cent of exchanges between neighbours and 46 per cent of exchanges between friends. Such work thus represents a key means for delivering community self-help and thus social cohesion and active citizenship in contemporary Ukraine. This monetisation of reciprocity, however, should not be confused with the penetration of the profit-motive into realms previously occupied by mutual aid. Monetisation of exchange does not always march hand-in-hand with profit-oriented motivations.

5.22 As the suppliers of paid favours reported, although this undeclared work was conducted to make a little money 'on the side', they primarily undertook these exchanges to provide a service to people they knew who might otherwise be unable to get the work completed. Recipients, similarly, paid somebody they knew but mostly to redistribute money to them in a way that does not appear to be 'charity' and/or to develop or cement social ties rather than purely to save money. It is important to state, however, that even if financial gain was not the principal rationale when engaging in paid favours, economic motives (i.e. redistribution, developing networks of material support) are still present, even if the motives are not 'economic' in the narrow sense of meaning profit-motivated. Similarly, when customers employ people they know, although the intention is often to help them out financially, there frequently remain strong economic motives behind their decision to pay this person on an undeclared basis; quite simply, to get the job done cheaper. It was commonly stated by respondents when employing closer social relations that 'we employed them because it was much cheaper asking them' and then a caveat was included such as 'but they also needed the money' or 'but we wanted to help them out because they are unemployed'.

5.23 The motives involved when conducting paid favours, therefore, stretch from motives more oriented towards financial gain at the end nearest to profit-motivated undeclared self-employment (and these paid favours tend to be conducted more by men) to motives associated mostly with wishing to help the other person out at the other end (conducted mostly by women). There is therefore a blurring of paid favours into the realm of undeclared self-employment as one move's along the spectrum away from pure not-for-profit rationales and towards profit motives. In addition, men become more prevalent as one moves closer to profit-motivated market-like self-employment and away from not-for-profit undeclared exchange.

Conclusions

6.1 The starting point of this paper was that a small but growing tributary of thought is beginning to challenge the conventional 'thin' representation of undeclared work as profit-motivated market-like exchange through the use of 'thicker' portrayals that recognise the presence of multifarious work relations and motives in this sphere. The outcome is that a more nuanced reading of the gendering of undeclared work has begun to emerge. Here, the intention has been to further advance this re-theorisation of the gender variations in the nature of undeclared work by analysing post-socialist Ukraine. The finding is that whilst over two-thirds (68 per cent) of men's undeclared work in this post-socialist society is composed of various types of profit-motivated market-like work, nearly three-quarters (72 per cent) of women's undeclared work is undertaken mostly for friends, neighbours and kin under relations more akin to unpaid mutual aid and for rationales other than financial gain.6.2 Representing undeclared work in conventional 'thin' terms as profit-motivated market-like endeavour is therefore found to represent undeclared work through the lens of men's lived practices rather than women's experiences. Of course, and particularly for those wishing to depict women's undeclared work as exploitative low-paid endeavour and a form of work that sits at the bottom of a hierarchy of types of employment, this more nuanced reading of the gendering of undeclared work will perhaps not sit easily with their preconceptions. However, it is important to state that the argument presented here is not refuting that women engage in undeclared work under sweatshop-like conditions. Indeed, many were identified in this study working under these conditions, such as in garment manufacturers. The point is that this is only one form of undeclared work and certainly not the most prominent type conducted by women at least in this society. Most of women's undeclared work is undertaken primarily for not-for-profit rationales for reasons associated with redistribution, helping out and developing networks of social and material support.

6.3 Some, of course, might assert that it is hardly surprising that the men in this study read their undeclared work through the traditional lens of their perceived role as providers and women through their perceived role as relationship builders. However, the important point is that the academic literature has until now almost entirely read undeclared work through the lens of what is predominantly men's representation of such work. It is crucial, therefore, to open up undeclared work in particular, and monetised exchange more generally, to alternative readings. Unless this is done, then other (and 'othered') voices, particularly of women, will continue to be unheard and accounts of undeclared work will remain dominated by what are in effect masculine-centred readings.

6.4 This paper has therefore opened up the possibility for the emergence of more nuanced accounts of the gendering of undeclared work than has so far been the case by revealing that the 'thicker' accounts that have begun to be discussed in relation to some countries in west Europe are also applicable in this post-socialist society. What is now required is a greater understanding of how the nature of undeclared work varies in post-socialist societies across different groups of men and women, whether ethnic variations exist and rural and urban variations. It is not just more nuanced accounts within post-socialist societies, however, that need to be pursued. Such thicker accounts of undeclared work in general, and the gendering of undeclared work more particularly, now also need to be applied to other countries and regions of the world, particularly the majority ('third') world. If this paper therefore encourages the emergence of these more nuanced accounts elsewhere so as to gain a clearer understanding of undeclared work and its gendered characteristics, and more broadly, facilitates greater consideration of the multifarious work relations and motives underpinning monetary exchange, then it will have achieved its objective.

Acknowledgements

This paper arises out of a project entitled 'Surviving post-socialism: evaluating the role of the informal sector in Ukraine', funded by the Economic and Social Research Council (RES000220985). We are indebted to Peter Rodgers for his research assistance. The usual disclaimers apply.References

ANDERSON, J. and GRAY, C. (2006) Anticorruption in Transition 3 Who Is Succeeding and Why? < http://siteresources.worldbank.org/INTECA/Resources/ACT3.pdf >BENERIA, L. (1999) 'The enduring debate over unpaid labour', International Labour Review, Vol.138, pp.287-309.

BOURDIEU, P. (2001) 'The forms of capital', in N. Woolsey Biggart (ed.) Readings in Economic Sociology. Oxford: Blackwell.

BROOKINGS INSTITUTE (2007) Urban Markets Initiative: the informal economy, < http://www.brookings.edu/metro/umi/collaboratory/informaleconomy.htm >.

CARRIER, J.G. (1997) (ed.) Meanings of the Market: the free market in western culture. Oxford: Berg.

CASTREE, N., COE, N. WARD, K. and SAMERS, M. (2004) Spaces of Work: global capitalism and the geographies of labour. London: Sage.

CHERNEYSHEV, I. (2006) Socio-Economic Activity and Decent Work in Ukraine: a comparative view and statistical findings. Working Paper no 76. Geneva: ILO.

CISCEL, D.H. and Heath, J.A. (2001) 'To market, to market: imperial capitalism's destruction of social capital and the family', Review of Radical Political Economics, 33, 4: 401-14.

CLARKE, S. (2002) Making ends meet in contemporary Russia: secondary employment, subsidiary agriculture and social networks. Cheltenham: Edward Elgar.

CORNUEL, D. and DURIEZ, B. (1985) 'Local exchange and state intervention', in N. Redclift and E. Mingione (eds.) Beyond Employment: household, gender and subsistence. Oxford: Basil Blackwell.

CRANG, P. (1997) 'Cultural turns and the (re)constitution of economic geography', in R. LEE and J. WILLS (Eds.) Geographies of Economies. London: Arnold.

CREWE, L. and Gregson, N. (1998) 'Tales of the unexpected: exploring car boot sales as marginal spaces of contemporary consumption', Transactions of the Institute of British Geographers, 23,1: 39-54.

CREWE, L. (2000) 'Geographies of retailing and consumption', Progress in Human Geography, Vol. 24, No. 2, pp. 275-90.

DAVIS, J. (1992) Exchange. Milton Keynes: Open University Press.

DELPHY, C. (1984) Close to Home. London: Hutchinson.

DZVINKA, R. (2002) How does the unofficial economy interact with the official one?, Economics Education and Research Consortium MA thesis. Kyiv: National University of Kyiv-Mohyla Aacademy.

EUROPEAN COMMISSION (1998) On Undeclared Work COM (1998) 219. Brussels: Commission of the European Communities.

EVANS, M., SYRETT, S. and WILLIAMS, C.C. (2006) Informal Economic Activities and Deprived Neighbourhoods. London: Department of Communities and Local Government.

FORTIN, B., GARNEAU, G., LACROIX, G., LEMIEUX, T. and MONTMARQUETTE, C. (1996) L'Economie Souterraine au Quebec: mythes et realites. Laval: Presses de l'Universite Laval.

GIBSON-GRAHAM, J.K. (1996) The End of Capitalism as We Knew It?: a feminist critique of political economy. Oxford: Blackwell.

GIBSON-GRAHAM, J.K. (2006) A Post-Capitalist Politics. Minneapolis: University of Minnesota Press.

GRABINER, Lord (2000) The Informal Economy. London: HM Treasury.

GREGORY, A. and WINDEBANK, J. (2000) Women and Work in France and Britain: theory, practice and policy. Basingstoke: Macmillan.

HANSON, M. (2006) Transition In Ukraine, NATO Parliamentary Assembly, report number 065 Escew 06 E.

HAPKE, L. (2004) Sweatshop: the history of an American idea. New Brunswick: Rutgers University Press.

HARVEY, D. (1989) The Condition of Post-Modernity: an enquiry into the origins of cultural change, Oxford: Blackwell.

HELLBERGER, C. and SCHWARZE J. (1986) Umfang und struktur der nebenerwerbstatigkeit in der Bundesrepublik Deutschland. Berlin: Mitteilungen aus der Arbeits-market- und Berufsforschung.

HOWE, L. (1990) Being Unemployed in Northern Ireland: an ethnographic study. Cambridge: Cambridge University Press.

INTERNATIONAL LABOUR OFFICE (2002) Decent Work and the Informal Economy. Geneva: International Labour Office.

JENSEN, L. and SLACK, T. (2008) 'Informal work in rural America', in E. MARCELLI and C.C. WILLIAMS (eds) Work in the Informal Economy. London: Routledge.

JENSEN, L., CORNWELL, G.T. and FINDEIS, J.L. (1995) 'Informal work in nonmetropolitan Pennsylvania', Rural Sociology, Vol. 60, No. 1, pp.91-107.

JORDAN, B., JAMES, S., KAY, H. and REDLEY, M. (1992) Trapped in Poverty? Labour-market decision in low-income households. London: Routledge.

KARPUSKIENE, V. (2007) Undeclared work, tax evasion and avoidance in Lithuania. Ppaper presented at colloquium of the Belgian Federal Service for Social Security on Undeclared Work, Tax Evasion and Avoidance, Brussels, June.

KESTELOOT, C. and MEERT, H. (1999) 'Informal spaces: the geography of informal economic activities in Brussels', International Journal of Urban and Regional Research, Vol. 23, pp. 232-51.

KITCHEN, R. and TATE, N. (2000) Conducting Research in Human Geography: theory, practice and methodology. London: Prentice Hall.

KNOTT, J. and MILLER, G. (2006) 'Social welfare, corruption and credibility', Public Management Review, Vol. 8, No. 2, pp. 227-52.

KOVEL, J. (2002) The Enemy of Nature: the end of capitalism or the end of the world?. London: Zed.

LEE, R. (1996) 'Moral money? LETS and the social construction of economic geographies in southeast England', Environment and Planning A, Vol. 28, pp. 1377-94.

LEE, R. (2000) ‘Shelter from the storm? Geographies of regard in the worlds of horticultural consumption and production’, Geoforum, 31: 137-57.

LEMIEUX, T., FORTIN, B. and FRECHETTE, P. (1994) 'The effect of taxes on labor supply in the underground economy', American Economic Review, Vol.84, No.1, pp. 231-54.

LEONARD, M. (1994) Informal Economic Activity in Belfast. Aldershot: Avebury.

LEONARD, M. (1998) Invisible Work, Invisible Workers: the informal economy in Europe and the US. London: Macmillan.

LOBO, F.M. (1990a) Irregular work in Spain, in Underground Economy and Irregular Forms of Employment Final Synthesis Report. Brussels: Office for Official Publications of the European Communities.

LOBO, F.M. (1990b) Irregular work in Portugal, in Underground Economy and Irregular Forms of Employment, Final Synthesis Report. Brussels: Office for Official Publications of the European Communities.

MACDONALD, R. (1994) 'Fiddly jobs, undeclared working and the something for nothing society', Work, Employment and Society, Vol. 8, No. 4, pp. 507-30.

MAUSS, M. (1966) The Gift, London: Cohen and West.

MCDOWELL, L. (1991) 'Life without father and Ford: the new gender order of post-Fordism', Transactions of the Institute of British Geographers, Vol.16, pp. 400-19

MCINNIS-DITTRICH, K. (1995) 'Women of the shadows: Appalachian women's participation in the informal economy', Affilia: Journal of Women and Social Work, Vol. 10, No. 4, pp. 398-412.

MEL'OTA, I. and GREGORY, P. (2001) New insights into Ukraine's shadow economy: has it already been counted?, Working Paper no. 1. Kyiv: Institute for Economic Research and Policy Consulting, German Advisory Group on Economic Reforms.

MINGIONE, E. (1991) Fragmented Societies: a sociology of economic life beyond the market paradigm. Oxford: Basil Blackwell.

MOGENSEN, G.V. (1985) Sort Arbejde i Danmark. Copenhagen: Institut for Nationalokonomi.

MOGENSEN, G.V. (1990) 'Black markets and welfare in Scandinavia: some methodological and empirical issues', in: M. ESTELLIE SMITH (ed.) Perspectives on the Informal Economy. New York: University Press of America.

MOISALA, J. (2004) Earnings in Europe: a comparative study on wages and income disparities in the European Union. Helsinki: Labour Institute for Economic Research.

MORRIS, L. (1987) 'Constraints on gender: the family wage, social security and the labour market: reflections on research in Hartlepool', Work, Employment and Society, Vol. 1, No. 1, pp. 85-106.

MORRIS, L. (1995) Social Divisions: economic decline and social structural change. London: UCL Press.

NEEF, R. (2002) 'Aspects of the informal economy in a transforming country: the case of Romania', International Journal of Urban and Regional Research, Vol. 26 No. 2, pp. 299-322.

NELSON, M.K. and SMITH, J. (1999) Working Hard and Making Do: surviving in small town America. Berkeley: University of California Press.

NELSON, M. and SMITH, J. (2008) 'Informal work in small town America', in E. MARCELLI and C.C. WILLIAMS (eds) Work in the Informal Economy. London: Routledge.

OECD (2002) Measuring the Non-Observed Economy. Paris: OECD.

ONS (2005) Identifying data sources on entrepreneurship and the informal economy. London: Office of National Statistics.

PAHL, R.E. (1984) Divisions of Labour. Oxford: Blackwell.

PECK, J. (2003) Economic sociologies in space, Paper presented to the workshop, A dialogue with economic geography and economic sociology: post-disciplinary reflections, University of Nottingham, Nottingham, 30 April.

PERSSON, A. and MALMER, H. (2006) Purchasing and performing undeclared work in Sweden: part 1: results from various studies,

PFAU-EFFINGER, B. (2004) Formal-Informal Work in Europe: 12-month progress report, < http://www.sozialwiss.uni-hamburg.de/publish/Isoz/pfau-effinger/fiwe/progress.html >.

RENOOY, P., IVARSSON, S., VAN DER WUSTEN-GRITSAI, O. and MEIJER, R. (2004) Undeclared Work in an Enlarged Union: an analysis of shadow work - an in-depth study of specific items. Brussels: European Commission.

RENOOY, P.H. (1990) The Informal Economy: Meaning, Measurement and Social Significance. Amsterdam: Netherlands Geographical Studies.

ROBERTS, K. and FAGAN, C. (1999) 'Old and new routes into the labour markets in ex-communist countries', Journal of Youth Studies, Vol. 2, pp. 153-70.

ROBERTS, K., CLARKE, S.C., FAGAN, C. and THOLEN, J. (2000) (eds.) Surviving Post-communism: young people in the former Soviet Union. Cheltenham: Edward Elgar.

ROSE, R. (2005) Insiders and Outsiders: New Europe Barometer 2004. Glasgow: Studies in Public Policy 404, Centre for the Study of Public Policy, University of Strathclyde.

ROSS, A. (2004) Low Pay High Profile: the global push for fair labor. London: New Press.

ROSS, R.J.S. (2004) Slaves to Fashion: poverty and abuse in the new sweatshops. Ann Arbor: University of Michigan Press.

ROUND, J. and WILLIAMS, C.C. (2008) 'Everyday tactics and spaces of power: the role of informal economies in post-Soviet Ukraine', Social and Cultural Geography, Vol. 9, No.2, pp. 171-85.

ROWLINGSON, K., WWHYLEY C., NEWBURN, T. and BERTHOUD, R. (1997). Social Security Fraud, DSS Research Report no. 64. London: HMSO.

SCHNEIDER, F. and ENSTE D.H. (1999) 'Shadow economies: size, causes and consequences', Journal of Economic Literature, Vol. 38, No. 1, pp. 77-114.

SEDLENIEKS K. (2003) 'Cash in an envelope: corruption and tax avoidance as an economic strategy in contemporary Riga', in K-O. ARNSTBERG and T. BOREN (eds) Everyday economy in Russia, Poland and Latvia. Stockholm: Almqvist & Wiksell.

SLATER, D. and TONKISS, F. (2001). Market Society: markets and modern social theory. Cambridge: Polity.

SMITH, A. and STENNING, A. (2006) 'Beyond household economies: articulations and spaces of economic practice in postsocialism', Progress in Human Geography, Vol. 30, No. 1, pp. 1-14.

THOMAS, J.J. (1992). Informal Economic Activity. Hemel Hempstead: Harvester Wheatsheaf.

TRANSPARENCY INTERNATIONAL (2005) Report on the Transparency International Global Corruption Barometer 2005, < http://transparency.org/policy_research/surveys_indices/gcb >

VAN ECK, R. and KAZEMEIER B. (1985). Swarte Inkomsten uit Arbeid: resultaten van in 1983 gehouden experimentele. Den Haag: CBS_Statistische Katernen nr 3, Central Bureau of Statistics.

VINAY, P. (1987) 'Women, family and work: symptoms of crisis in the informal economy of Central Italy', Sames 3rd International Seminar Proceedings University of Thessaloniki, Thessaloniki.

WILLIAMS, C.C. (2004a) 'Cash-in-hand work: unravelling informal employment from the moral economy of favours', Sociological Research On-Line, Vol. 9, No.1.

WILLIAMS, C.C. (2004b) Cash-in-Hand Work: the underground sector and the hidden economy of favours. Basingstoke: Palgrave.

WILLIAMS, C.C. (2005) 'Unraveling the meanings of underground work', Review of Social Economy, Vol. 63, No. 1, pp. 1-18.

WILLIAMS, C.C. (2006) 'Evaluating the magnitude of the shadow economy: a direct survey approach', Journal of Economic Studies, Vol. 33, No. 5, pp. 369–85.

WILLIAMS, C.C. and ROUND, J. (2007) 'Beyond negative depictions of informal employment: some lessons from Moscow', Urban Studies, Vol.44, No. 12, pp. 2321-38.

WILLIAMS, C.C. and ROUND, J. (2008) 'Re-theorising the nature of informal employment: some lessons from Ukraine', International Sociology, Vol. 23, No. 3, pp. 367-88.

WILLIAMS, C.C. and WINDEBANK, J. (1998) Informal Employment in the Advanced Economies: implications for work and welfare. London: Routledge.

WILLIAMS, C.C. and WINDEBANK, J. (2003) 'Reconceptualizing women's paid informal work: some lessons from lower-income urban neighbourhoods', Gender, Work and Organisation, Vol.10, No.3, pp.281-300.

WILLIAMS, C.C. and WINDEBANK, J. (2006) 'Re-reading undeclared work: a gendered analysis', Community, Work and Family, Vol. 9, No.2, pp.181-96.

WILLIAMS, C.C., ROUND, J. and RODGERS, P. (2007) 'Beyond the formal/informal economy binary hierarchy', International Journal of Social Economics, vol. 34, no.6, pp. 402-14.

WOOLFSON, C. (2007) 'Pushing the envelope: the "informalization" of labour in post-communist new EU member states', Work, Employment & Society, Vol. 21, No. 3, pp. 551-64.

WORLD BANK (2005) Ukraine Jobs Study: fostering productivity and job creation, Washington DC: World Bank.

ŽABKO, M.A. and RAJEVSKA, F. (2007) Undeclared work and tax evasion: case of Latvia. Paper presented at colloquium of the Belgian Federal Service for Social Security on Undeclared Work, Tax Evasion and Avoidance. Brussels, June.

ZELIZER, V.A. (1994) The Social Meaning of Money, New York: Basic Books.

ZELIZER, V.A. (2005) 'Circuits within capitalism' in V. NEE and R. SWEDBERG (eds) The Economic Sociology of Capitalism, Princeton: Princeton University Press.